3/24 price analysis: ADA, DOGE, MATIC, SOL, DOT, LTC, BTC, ETH, BNB, XRP

As the weekend approaches and investor concerns about Deutsche Bank emerge, Bitcoin and other altcoins may see profit-taking and risk-off positioning.

Yet again european securities exchanges fell on Walk 24 on restored fears that the financial emergency could show up to wreak havoc. On March 23, Deutsche Bank’s credit default swaps, which provide buyer protection from specific risks, surged without a known catalyst, triggering the most recent selling. The German lender’s shares fell by 11% as a result.

Christine Lagarde, president of the European Central Bank, attempted to calm the markets by stating that the baking industry in the euro area was robust as a result of the regulatory reforms implemented following the global financial crisis. That could be one of the reasons why the intraday lows that the US equity markets recovered from were so strong.

The banking crisis has helped Bitcoin’s price, but if the contagion spreads, the trend may stop. Traders sell assets to reduce risk during panic. If Bitcoin does not fall below the $25,000–$20,000 support zone at that point, it will indicate that the bear phase has ended.

Could there be a minor correction in Bitcoin and the majority of major altcoins? Which crucial support levels should be monitored? To find out, let’s examine the charts of the top ten cryptocurrencies.

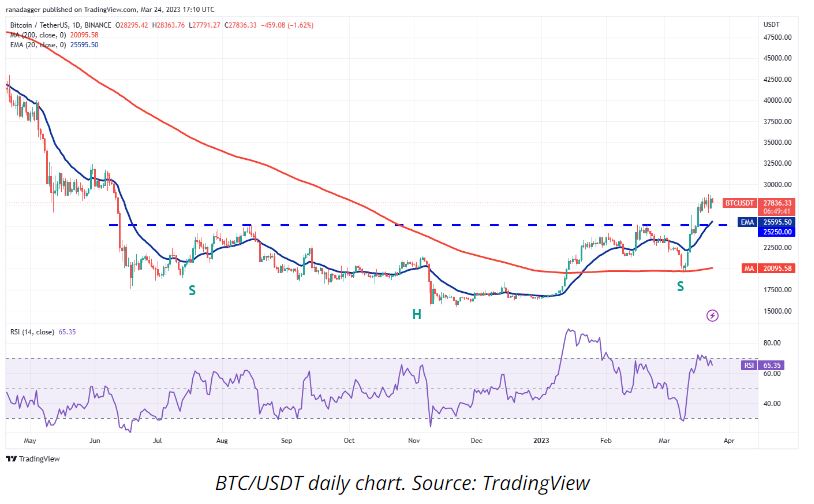

Bitcoin price analysis

Bitcoin shaped an inside-day candle design on Walk 23, demonstrating vulnerability among purchasers and merchants. The bears are unwilling to give in, despite the bulls’ desire to extend the uptrend. As a result, the price has stayed within a narrow range.

A tight consolidation near a local high typically indicates that traders do not rush to book profits because they anticipate the uptrend will continue. The relative strength index, or RSI, near the overbought zone and the rising 20-day exponential moving average, or EMA ($25,595), indicate that bulls are in control.

The bulls will once more attempt to initiate the subsequent rally leg if the price recovers strongly from $26,500. That could drive the cost to $30,000 and afterward to $32,500.

Because a break and close below the $25,250 support level may indicate a bull trap, it remains the crucial level. The BTC/USDT pair might then fall toward the SMA, or 200-day moving average, which is $20,095.

Get to know Godleak

Godleak crypto signal is a service which comprise of a professional team. They tried to provide you signals of best crypto channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

Ether price analysis

Ether transcended the above opposition of $1,842 on Walk 23, yet the bulls couldn’t support the breakout as seen from the long wick on the candle.

By pushing the price toward the $1,693 20-day exponential moving average, the bears are attempting to bolster their position. On the downside, this is still the most important level to keep an eye on.

Traders will continue to view dips to the 20-day EMA as buying opportunities if the price rises above this level. After that, the bulls will attempt once more to break through the overhead barrier and propel the price to $2,000

If the price falls below the 20-day EMA in the near future, this optimistic outlook will be wiped out. That could raise the cost to $1,461 and then $1,600, respectively.

BNB price analysis

On March 23, BNB bounced off the 20-day EMA ($316), but the bulls are having trouble maintaining the relief rally. This demonstrates that the bears take advantage of any slight recovery.

The price will be pushed below the 20-day EMA by sellers. The BNB/USDT pair might fall to $300 and then to $289 below the 200-day moving average (SMA). It is anticipated that the bulls will vigorously defend the region between the 200-day SMA and $265.

On the other hand, if the price recovers from the 20-day EMA, it will indicate that traders are buying the dips and that sentiment remains upbeat. The next stop on the upside is $400, and the pair may gain momentum above $346.

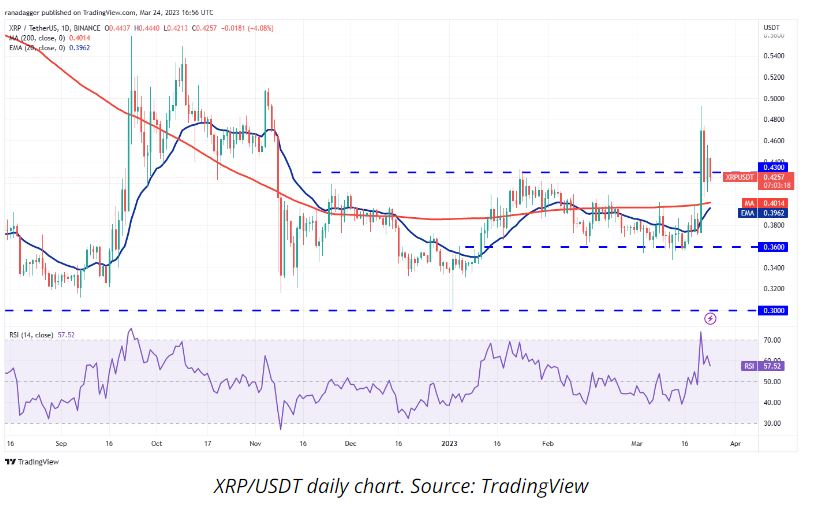

XRP price analysis

On March 22 and 23, XRP displayed indecisiveness on the part of both buyers and sellers when it displayed consecutive inside-day candlestick patterns.

The bulls’ ability to successfully defend the 200-day SMA ($0.40) over the past three days is a minor plus for them. The 200-day SMA may now serve as the new floor, according to this.

After a sharp move, the price may sometimes settle down for a few days before resuming a trend. To signal the beginning of the next uptrend leg, buyers will need to push the price above $0.51. On the negative side, a retest of $0.36 could occur if the price falls below the moving averages.

Cardano price analysis

Since March 21, the bulls have maintained Cardano’s ADA above the moving averages, but they have failed to reach the H&S pattern’s neckline. This suggests that the bears are selling near $0.39.

The RSI is just above the midpoint, indicating a slight advantage for the bulls, and the 20-day EMA ($0.34) is making an attempt to move higher. The likelihood of a rally to the neckline increases if the price rises from the 20-day exponential moving average. A break over the H&S design demonstrates the beginning of another possible up-move.

On the other hand, bears may attempt a comeback if the price falls below the 20-day EMA. The price could fall to $0.24 if the break and close are below $0.30.

Dogecoin price analysis

Dogecoin’s bulls have been attempting to break above the 200-day SMA ($0.08), but the bears have not wavered.

The bears will next attempt to pull the cost to areas of strength for the at $0.07. The DOGE/USDT pair may remain stuck between the $0.07 and the 200-day SMA for some time longer if it makes a strong recovery from this level.

The first sign that the bulls have defeated the bears will be a break and close above the 200-day SMA. That might begin an up-push toward the firm above obstruction zone of $0.10 to $0.11. On the other hand, the pair might fall to $0.06 if the support at $0.07 breaks.

Polygon price analysis

Polygon’s MATIC has been exchanging underneath the 20-day EMA ($1.14) since Walk 20. This suggests that the bears want to turn the 20-day exponential moving average into resistance.

A minor positive in favor of the bulls is that the bears have not been able to sink the price below the strong support zone of $1.05 and the 200-day SMA ($0.96). This suggests strong buying at lower levels.

If buyers push the price above the 20-day EMA, the MATIC/USDT pair may rise toward the overhead resistance at $1.30. Such a move will suggest that the pair may continue its range-bound action between $1.05 and $1.30 for some more time. A break above or below this range could start the next trending move.

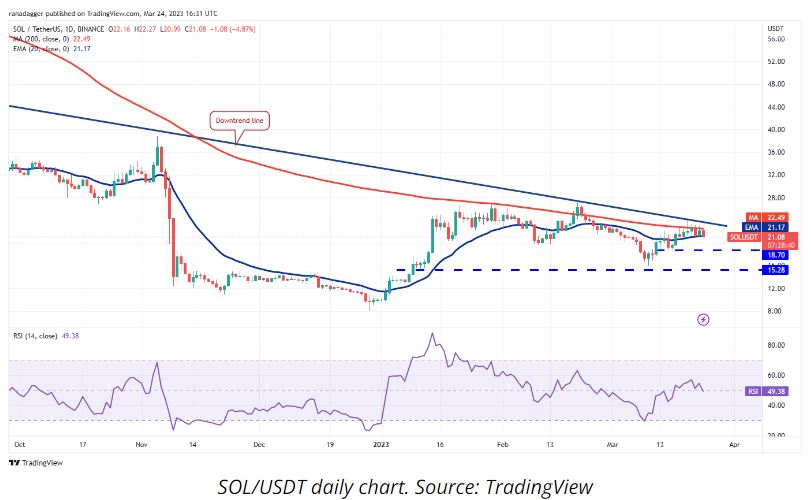

Solana price analysis

Solana’s SOL’s price action has further narrowed and is now stuck between the moving averages. This suggests that both bulls and bears are unsure of the next directional move.

The RSI near the midpoint and the flat 20-day EMA ($21.17) neither clearly benefit the bulls nor the bears.

Buyers will need to raise the price above the overhead resistance zone between the downtrend line and $27.12 in order to prevail. A possible shift in the trend will be indicated if they do that. After that, the SOL/USDT pair might try to rally to $39.

On the other hand, bears will attempt to drag the pair to the crucial support zone between $18.70 and $15.28 if the price falls below the 20-day EMA.

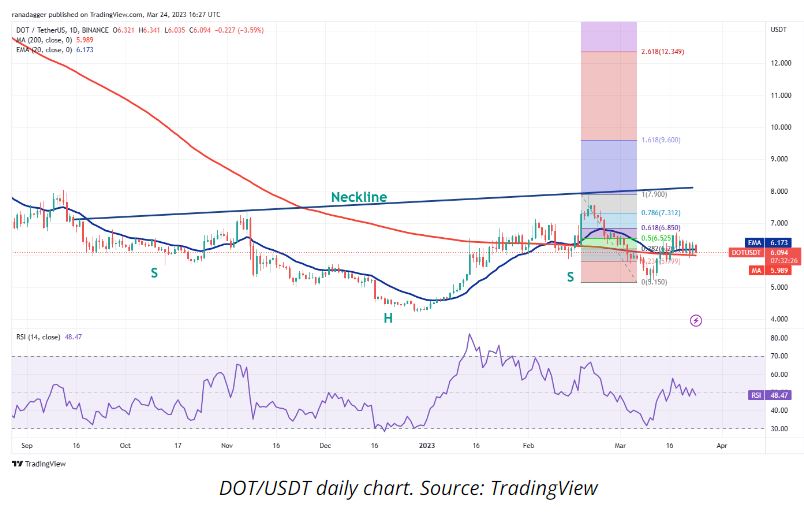

Polkadot price analysis

Polkadot’s Dab has been exchanging near the 200-day SMA ($5.98) for the beyond couple of days. A lack of demand at higher levels is indicated by the bulls’ inability to successfully rebound from significant support.

This increases the risk of a break below the 200-day SMA. If that happens, the DOT/USDT pair could slide to $5.15. This is an important support to keep an eye on because a break below it will open the doors for a probable retest of $4.22.

This short-term bearish view will be invalidated if the bulls push and sustain the price above the 61.8% Fibonacci retracement level of $6.85. If this level is taken out, the pair could reach the neckline of the developing H&S pattern.

Litecoin price analysis

The value of Litecoin is rising significantly. On March 22, when the bulls moved the price above the 20-day EMA (85), the momentum picked up.

The bulls have the upper hand because the RSI has moved into positive territory and the 20-day EMA has begun to rise. The overhead resistance at $106, where the bears may mount a strong defense, will be challenged by buyers. On the off chance that bulls clear this obstacle, the LTC/USDT pair might revitalize to $115 and accordingly to $125.

On the other hand, if the price falls back below $106 once more, it will suggest that bears will not back down. That may cause the price to fall below the 20-day EMA. A break beneath this help will allude to a potential territory development temporarily.