Avalanche (AVAX) Breakout from Consolidation Faces Potential Failure

In Brief

- Avalanche’s price recently broke out of its consolidation within $39 and $31, which it might fail.

- Market cues suggest a decline is next for the altcoin as the MACD is close to a bearish crossover.

- Nearly $409 million worth of AVAX is sitting between $37 and $41, awaiting profits, creating resistance.

Avalanche’s (AVAX) price is facing significant resistance that could potentially invalidate the potential of a rally and push the altcoin back into consolidation.

AVAX holders could change the outcome, but they, too, would need incentives that the crypto asset may not be able to offer.

Avalanche’s Bullishness May Be Short-Lived

Avalanche’s price at $37 had broken out of the month-long consolidation it was in, reigniting investors’ optimism about gains. But AVAX fell back below the resistance of $39, essentially reinitiating consolidation.

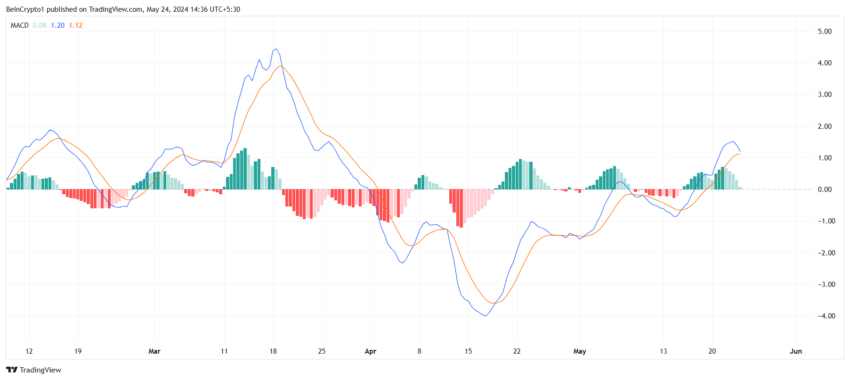

One reason behind this is the lack of push from the broader market, as evidenced by the Moving Average Convergence Divergence (MACD). MACD is a momentum indicator that shows the relationship between two moving averages of a security’s price, providing buy and sell signals.

For the last couple of days, the MACD has maintained a bullish crossover, but this could change soon. At the moment, the signal line is close to moving above the MACD line, and when that happens, a bearish crossover will be confirmed.

Get to know Godleak

Godleak crypto signal is a service which provide profitable crypto and forex signals for trading. Godleak tried to provide you signals of best crypto vip channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

Join for Free

☟☟☟☟☟

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

This could disrupt the potential rally.

In addition, Avalanche’s price is facing major resistance between $37 and $41. This is because, according to the Global In/Out of the Money (GIOM) indicator, AVAX holders bought about 11.9 million AVAX worth $409.7 million in this range.

To break out of the consolidation, the altcoin would first need to make this supply profitable. This could sustain investors’ bullishness as well. They would be incentivized to participate on the network and push the price further up.

However, the chances of this supply becoming profit-bearing are unlikely since the bullish cues are weak currently.

AVAX Price Prediction: Two Limits to Watch

Avalanche’s price, trading at $37, could gradually fall to support at $31 since the aforementioned factors suggest a bearish outcome. The resistance at $39 and support at $31 are the two limits of consolidation that AVAX has been in for more than a month.

But if the market observes bullish cues, Avalanche’s price would have a shot at reclaiming $39 as a support floor. Doing so would initiate a recovery for AVAX, sending it to $42.

The next major resistance is 45. If the altcoin reaches it, the bearish thesis can be considered invalidated.