Is the Bitcoin, Altcoin Bull Market Over? Analysts Weigh In

In Brief

- Bitcoin’s future hinges on macroeconomic factors, with scenarios ranging from $30,000 to $60,000.

- Analysts predict either significant corrections or consolidation phases for Bitcoin and altcoins.

- Sentiment and key price levels play a crucial role in market direction, say industry experts.

The cryptocurrency market has experienced significant turbulence recently, raising questions about the longevity of the current bull market in Bitcoin and altcoins.

Analysts and industry insiders offer varied perspectives on the future of Bitcoin and altcoins, reflecting on market trends, macroeconomic factors, and investor behavior.

Analysts’ Predictions on Bitcoin, Altcoins

Bitcoin investor Murad Mahmudov highlighted two possible scenarios for Bitcoin’s future. He suggested that if the price remains above $60,000, the bull market might continue following the typical four-year cycle.

However, depending on macroeconomic conditions, a global recession could drive Bitcoin’s price down to $30,000.

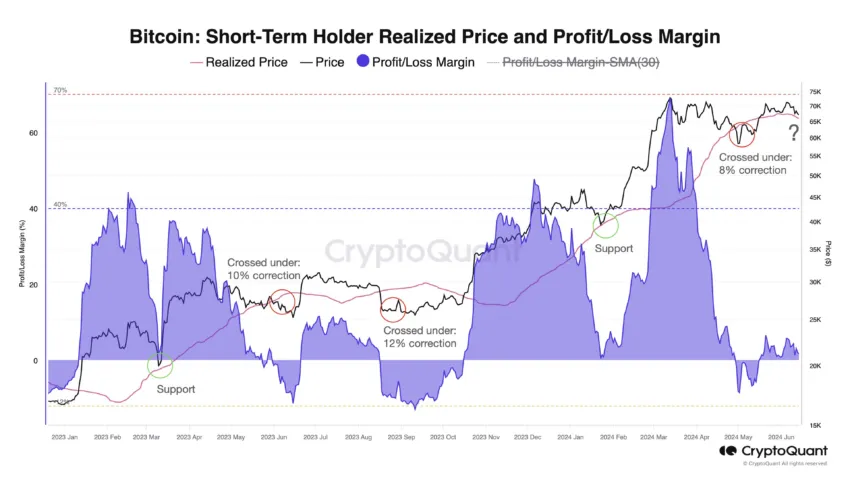

Likewise, Julio Moreno, Head of Research at CryptoQuant, pointed out the high probability of Bitcoin reaching $60,000. He said that Bitcoin is at a crucial price level, around the short-term holders’ realized price of $62,800.

This metric could either provide support or lead to an 8% to 12% correction if the price drops below this level, potentially bringing Bitcoin down to about $60,000.

Get to know Godleak

Godleak crypto signal is a service which provide profitable crypto and forex signals for trading. Godleak tried to provide you signals of best crypto vip channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

Join for Free

☟☟☟☟☟

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

From a technical perspective, trading veteran Peter Brandt warned that breaking through the $60,000 support levels could lead to further declines. He noted that a drop below $60,000 might see Bitcoin reaching $48,000.

Meanwhile, market analyst Bob Loukas took a more moderate stance, predicting a period of consolidation similar to what was observed last summer. He emphasizes the possibility of a repeated pattern, suggesting that patience might be required as the market stabilizes.

“Last summer’s consolidation, visualized this summer. Not saying it’s going to repeat, but serves as a reminder of what’s possible and the patience that might be needed,” Loukas said.

Will Clemente, co-founder of Reflexivity Research, also anticipates a consolidation phase. He has adjusted his investment strategy, retaining only core Bitcoin holdings and a few other positions.

Clemente believes that while Bitcoin might experience a sideways movement during the summer, there is potential for higher prices in the fourth quarter, influenced by economic data and Federal Reserve actions.

Regarding altcoins, Andrew Kang, co-founder of Mechanism Capital, expressed caution. He remains unsure if the momentum generated by Bitcoin exchange-traded fund (ETF) approval will extend to altcoins, particularly Ethereum. While Bitcoin might see increased interest, he doubts the same for Ethereum ETFs.

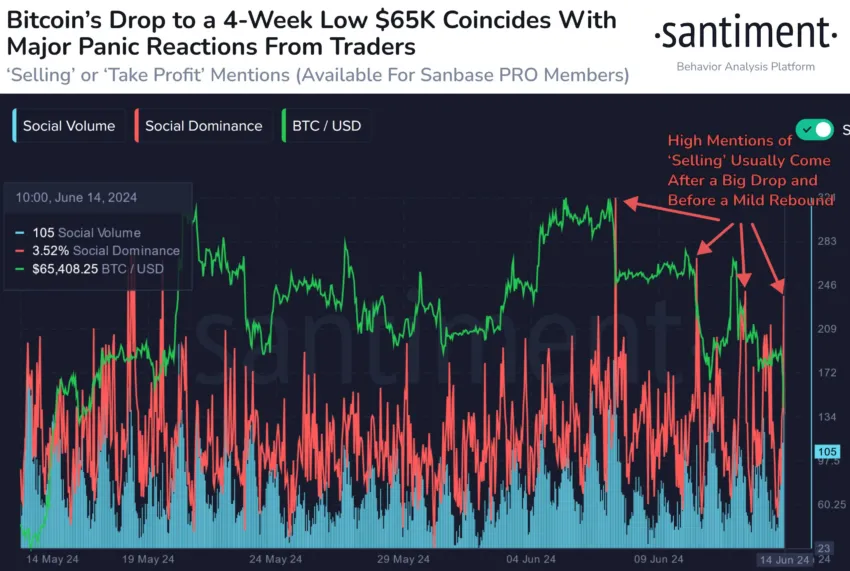

Despite the pessimistic outlook, analysts at blockchain analytics firm Santiment noted the current market sentiment. They observe heightened fear among investors as Bitcoin’s price drops to $65,000. If panic selling continues, this fear could lead to a temporary bounce and a buying opportunity.

“Spikes in mentions of selling or taking profit are common after a drop, and a temporary bounce and buy opportunity may form if we see continued FUD and panic from small traders,” Santiment explained.

In summary, the future of the Bitcoin and altcoin bull market is uncertain. Potential outcomes range from significant corrections to periods of consolidation. The direction will largely depend on macroeconomic factors and shifts in investor sentiment.