BTC Miners Drain Their Holdings as $100,000 Target Stays Out of Reach

In Brief

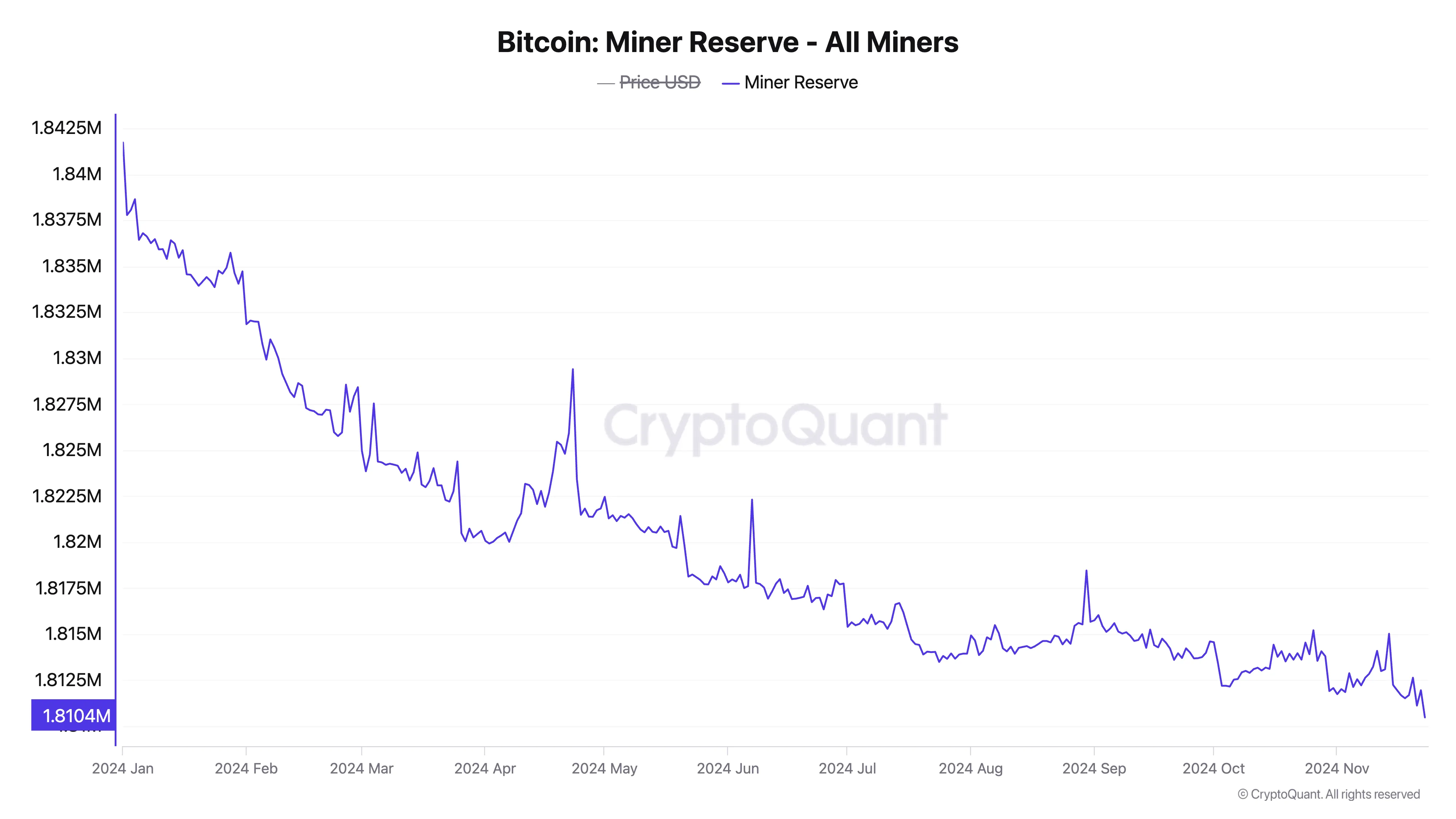

- BTC miner reserves have dropped to 1.81M BTC, a year-to-date low, as miners sell coins to secure profits or offset rising operational costs.

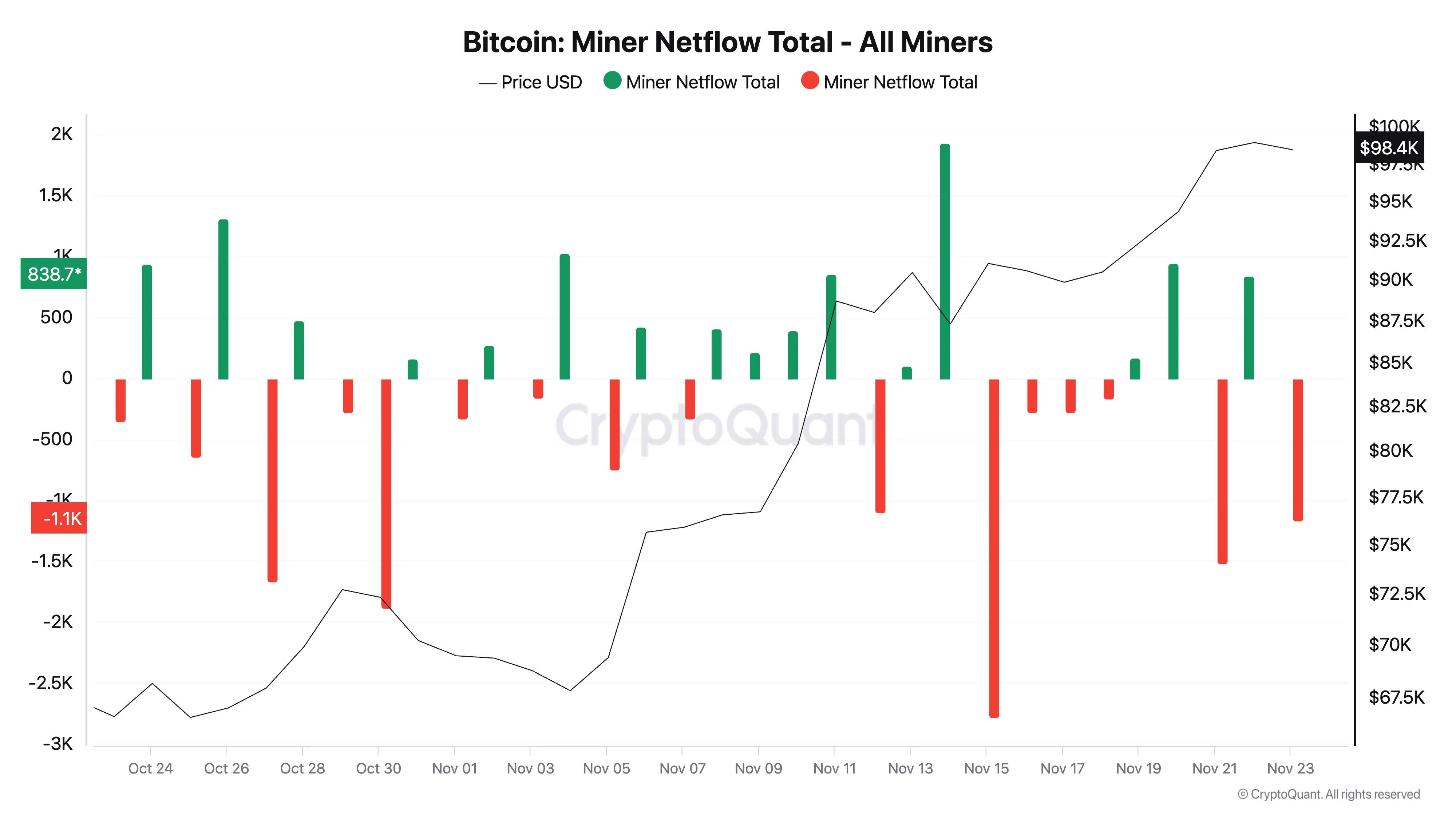

- Negative miner netflow highlights sustained sell-offs, signaling potential downward pressure on BTC’s price.

- Parabolic SAR remains bullish, suggesting BTC could reclaim $99,860 and break $100K if buying pressure outweighs miner sell-offs.

Bitcoin miners have been actively reducing their holdings in recent weeks as the coin’s price continues to hover below the critical $100,000 mark. At press time, the leading coin trades at $98,535, noting a 1% decline from its all-time high of $99,860 recorded during Friday session.

As the BTC market begins to trend sideways, its miners may be prompted to further distribute their holdings for profit or to offset growing mining costs.

Bitcoin Miners Sell Their Holdings

According to CryptoQuant’s data, Bitcoin’s miner reserve has fallen to its lowest level since the beginning of the year. As of this writing, it sits at 1.81 million BTC.

This metric tracks the number of coins held in miners’ wallets. It represents the coin reserves miners have yet to sell. A decline in the BTC miner reserve indicates that miners on the Bitcoin network are distributing their coins either to take profits or to cover mining-related costs.

Moreover, readings from BTC’s miner netflow confirm the daily trend of coin sell-offs by the network’s miners. As of this writing, the metric’s value is negative at -1,172 BTC.

Miner netflow refers to the net amount of Bitcoin that miners are buying or selling. It is calculated by subtracting the amount of Bitcoin miners are selling from the amount they are buying. When it is negative, it indicates that miners are selling more coins than they are buying. This is often a bearish signal and a precursor to a short-term downward trend in the coin’s price.

BTC Miners

Get to know Godleak

Godleak crypto signal is a service which provide profitable crypto and forex signals for trading. Godleak tried to provide you signals of best crypto vip channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

Join for Free

☟☟☟☟☟

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

BTC Price Prediction: The Bulls Remain in Control

While BTC miners have added to the coin’s selling pressure over the past few weeks, the bullish bias toward the king coin remains significant. This is reflected in the positioning of the dots that make up its Parabolic Stop and Reverse (SAR) indicator. As of this writing, these dots rest below BTC’s price.

The Parabolic SAR identifies an asset’s trend direction and potential reversal points. When its dots are positioned under the asset’s price, it suggests a bullish trend. Traders interpret this as a signal to go long and exit short positions.

If this trend persists, BTC’s price will reclaim its all-time high of $99,860 and may rally past the $100,000 psychological barrier. On the other hand, a spike in profit-taking activity will invalidate this bullish outlook. If buying pressure weakens, BTC’s price may drop to $88,986.