Analysts See 75% Chance of Spot Ethereum ETF Approval as SEC Signals Possible Shift

In Brief

- Analysts raise spot Ethereum ETF approval odds to 75%.

- SEC’s move to update filings ignites industry anticipation.

- ETH price jumps 19.98% following the analysts’ prediction.

Analysts have increased their odds of spot Ethereum exchange-traded fund (ETF) approval. This shift in sentiment comes amid renewed optimism about regulatory approval from the US Securities and Exchange Commission (SEC).

The move signals a potential breakthrough in the prolonged quest for a spot Ethereum ETF.

Renewed Optimism for Spot Ethereum ETF Approval

Eric Balchunas and James Seyffart, ETF analysts at Bloomberg Intelligence, recently announced that they are increasing their odds of spot Ethereum ETF approval from 25% to 75%. Balchunas explained the reason behind their renewed optimism.

“Hearing chatter this afternoon that the SEC could be doing a 180 on this increasingly political issue, so now everyone scrambling. But again, we capping cat 75% until we see more, e.g., filing updates,” Balchunas wrote on his X (Twitter) account.

The SEC reportedly requested asset managers that want to list spot Ethereum ETFs to update 19b-4 filings ahead of the deadline this week. This move has sparked speculation and activity within the industry as stakeholders anticipate potential approval.

Balchunas also referred to a statement from ETF Store’s Nate Geraci. reported that Geraci predicted the “SEC to approve 19b-4s & then slow play S-1s.”

The 19b-4 filings propose rule changes necessary for listing new products, like spot Bitcoin or Ethereum ETFs, on stock exchanges. Meanwhile, S-1 registration forms provide detailed information about new securities offered to the public, including the fund’s structure, management, and investment strategy. It is important to note that the issuers must get approval for both forms to officially launch the ETFs in the market.

Get to know Godleak

Godleak crypto signal is a service which provide profitable crypto and forex signals for trading. Godleak tried to provide you signals of best crypto vip channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

Join for Free

☟☟☟☟☟

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

However, Seyffart noted that their increased odds are only for “the 19b-4 May 23 deadline,” referring to VanEck’s spot Ethereum ETFs approval.

“It could be weeks to months before we see S-1 approvals and, thus, a live Ethereum ETF,” Seyffart added.

This development is particularly interesting given that both Seyffart and Balchunas had been decreasing their odds for the past months. Moreover, prominent figures in the industry, including Jan van Eck, CEO of asset manager VanEck, have expressed their pessimism on the spot Ethereum ETF approval.

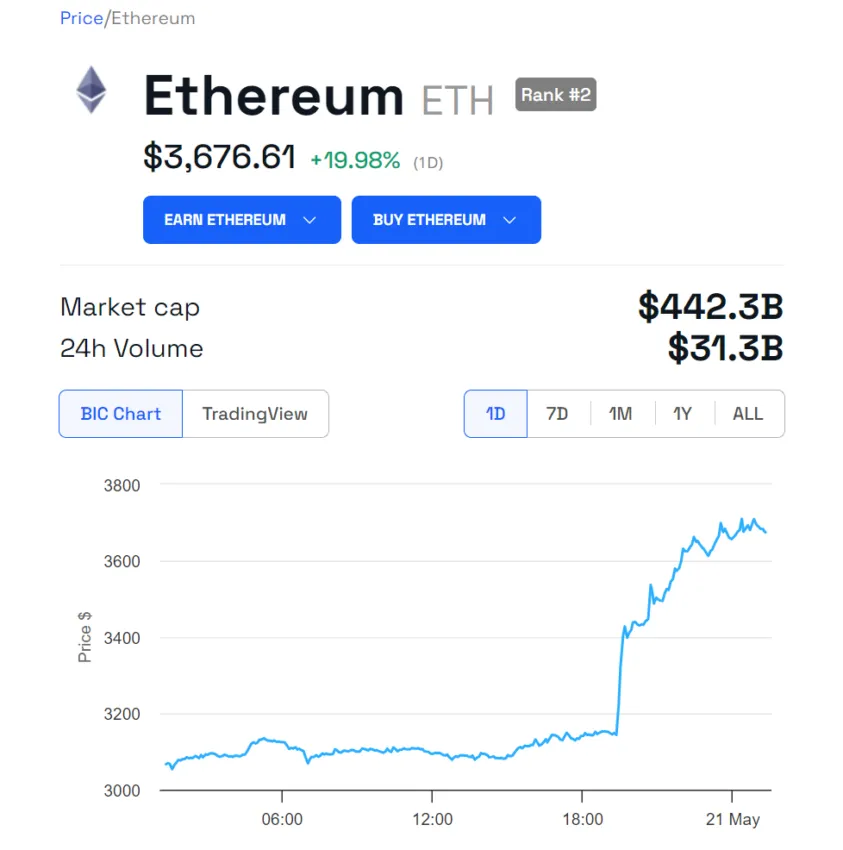

Following this news, Ethereum’s (ETH) price has significantly increased. According to data, ETH’s price has surged by 19.98% in the last 24 hours. At the time of writing, ETH is now trading at $3,676.

The market optimism extends to Ethereum betas—altcoins under the Ethereum ecosystem—including Polygon (MATIC) and Optimism (OP). For the last 24 hours, MATIC and OP prices have risen 9.4% and 19.7%, respectively.

Overall, this heightened probability of approval has infused the market with renewed enthusiasm. As the SEC’s decision looms, industry stakeholders are closely monitoring updates.