Bitcoin Scarcity Post-Halving Will Trigger a Steady Bull Run

In Brief

- Bitcoin’s upcoming halving event, scheduled every four years, reduces mining rewards and is expected to intensify market competition.

- Involvement from institutional investors and countries like El Salvador indicates a growing acceptance of Bitcoin as a mainstream asset.

- The halving could prompt regulatory and technological advancements, strengthening Bitcoin’s position as a unique asset class.

Bitcoin approaches another critical milestone — its scheduled halving event. It is a programmed reduction in the rewards miners receive for verifying transactions.

The halving is a pivotal event that has historically influenced Bitcoin’s value and the broader cryptocurrency market.

Increasing Scarcity Meets Growing Demand

The halving occurs approximately every four years and is part of Bitcoin’s unique monetary policy. It mimics the scarcity and value preservation of precious metals like gold.

Get to know Godleak

Godleak crypto signal is a service which provide profitable crypto and forex signals for trading. Godleak tried to provide you signals of best crypto vip channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

Join for Free

☟☟☟☟☟

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

“Over the past various cycles, we’ve seen more and more demand for Bitcoin, in contrast to the supply staying the same. So, if you look at it from a macroeconomic standpoint, more demand and the same supply drive the price up,” Sheraz Ahmed, Managing Partner at STORM Partners, told Vipkhoone.

Indeed, as the halving reduces the rate at which new BTC are generated, it adjusts the supply side of the equation. This has traditionally led to a bullish sentiment among investors. Essentially, the reduced flow of new coins intensifies competition for existing ones.

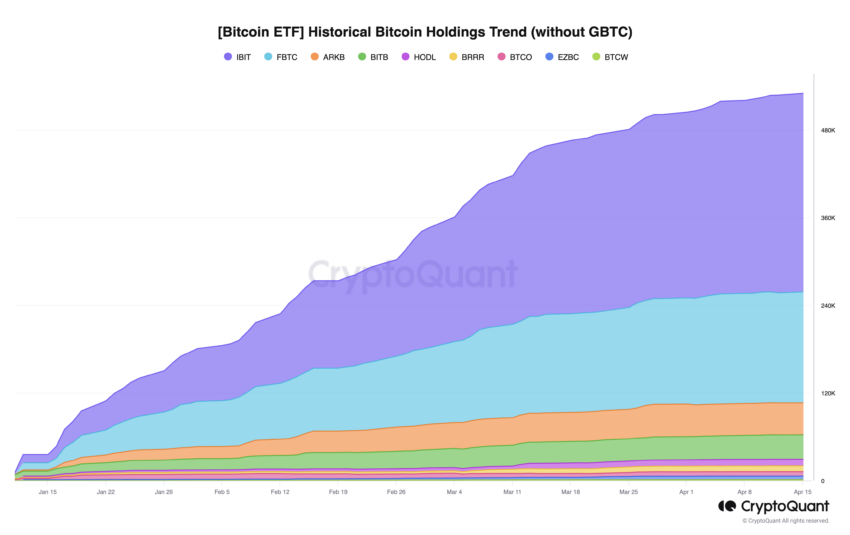

The forthcoming halving could further exacerbate this trend, given the increasing involvement of large institutional investors through Bitcoin Exchange-Traded Funds (ETFs).

“If you look at Bitcoin ETFs in the US, they are aggregating a lot of the demand from players such as pension funds and kind of the smaller institutional players. They are buying a lot of Bitcoin, sometimes as much as they can, on a daily basis. The fact that the halving will cause less Bitcoin to be minted will mean it will be harder for them to fill that demand,” Ahmed added.

Likewise, countries like El Salvador have already started diversifying part of their treasury assets into Bitcoin. This hints at a broader acceptance and normalization of Bitcoin as a mainstream financial asset. Furthermore, governmental involvement could amplify demand pressures post-halving, as noted by STORM’s analysts.

Bitcoin’s Steady Bull Run After the Halving

This massive buy-in could stabilize Bitcoin’s price fluctuations. “I don’t think we’ll see a dramatic swing up or down. However, it’s going to be quite constant. It will constantly grow,” Ahmed suggested, indicating a belief in the maturation of the market and a less volatile Bitcoin.

While some market participants use halving events to forecast Bitcoin price movements and trading strategies, they also recognize it as a time to reflect on Bitcoin’s technological and regulatory advancements. Many jurisdictions craft regulatory frameworks that are more favorable to Bitcoin than other speculative crypto assets, which bodes well for its mainstream adoption.

For this reason, there is a growing belief that Bitcoin should be reclassified away from being just another cryptocurrency.

“I don’t believe Bitcoin should be in the league of other cryptocurrencies. Bitcoin is its own beast, and it’s very different to Ethereum and the others. None of them are competing with it. Bitcoin has around 52% of the market share today. I’m a big believer that it should graduate from the “school of cryptocurrencies” and become an actual asset that can be traded with other commodities such as gold, silver, copper, and the like,” Ahmed concluded.

Looking forward, the cap on Bitcoin’s total supply — only 21 million coins can ever be mined — poses fascinating economic inquiries about what happens when all coins are minted. This scarcity could lead to significant shifts in Bitcoin’s role in both financial and technological sectors.