Bitcoin Smashes Past $110,000 as ETF Inflows Hit 6-Day Streak

In Brief

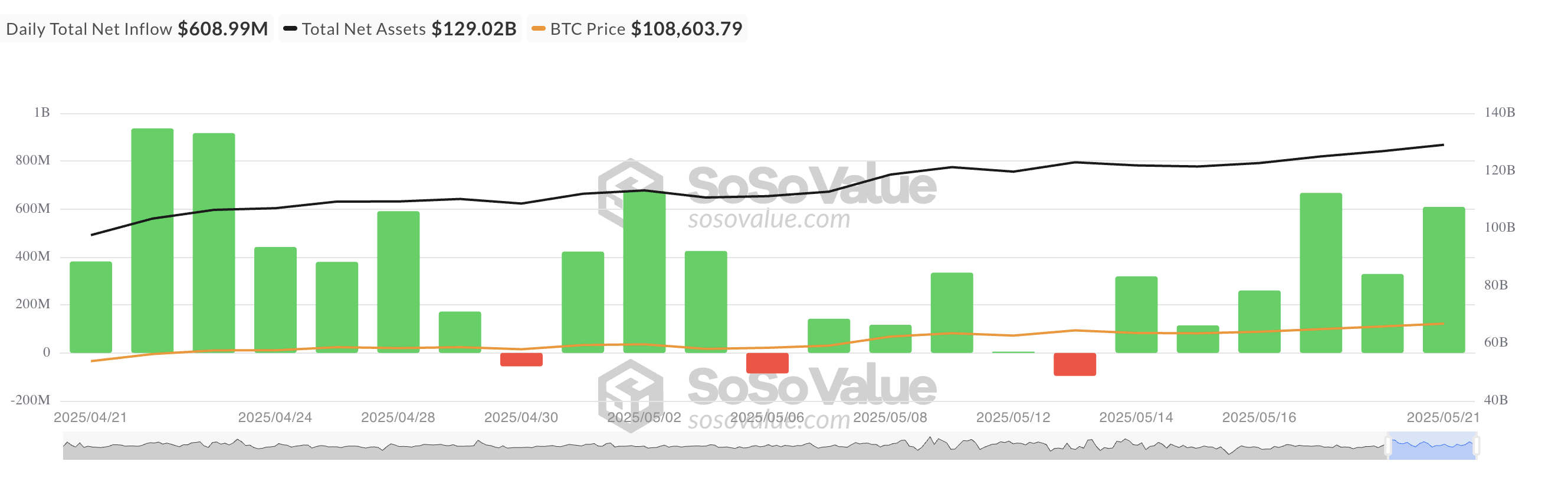

- Bitcoin spot ETFs see $608.99 million in inflows, marking the sixth day of rising investor confidence.

- Bitcoin surpasses $110,000, with the price briefly hitting an all-time high of $111,880 amid strong market optimism.

- BlackRock’s IBIT ETF leads with $530.63 million in inflows, signaling growing institutional interest in BTC.

Bitcoin spot exchange-traded funds (ETFs) saw growth on Wednesday as these products recorded another day of significant inflows, exceeding $600 million.

Yesterday’s figure represented the sixth consecutive day of net inflows into BTC spot ETFs, a signal of climbing investor confidence in the leading digital asset.

Bitcoin ETF Inflows Climb 85% Amid Bullish Run Above $110,000

BTC’s break above the $110,000 psychological price mark yesterday triggered notable inflows into spot ETFs. According to SosoValue, investors poured $608.99 million in new capital into these funds, pushing the total net asset value of all BTC spot ETFs to $129.02 billion.

Wednesday’s inflows were 85% higher than the $329 million recorded on Tuesday. This was also the sixth consecutive day of net inflows into BTC spot exchange-traded funds, a sign of growing investor optimism in the coin.

BlackRock’s ETF IBIT recorded the largest daily net inflow, totaling $530.63 million, bringing its total cumulative net inflows to $46.68 billion.

Fidelity’s ETF FBTC recorded the second-highest net inflow of the day, recording $ 23.53 million. The ETF’s total historical net inflows now stand at $11.83 billion.

Get to know Godleak

Godleak crypto signal is a service which provide profitable crypto and forex signals for trading. Godleak tried to provide you signals of best crypto vip channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

Join for Free

☟☟☟☟☟

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

Bitcoin Rallies to Fresh Record; Options Traders Show Cautious Optimism

During Thursday’s early Asian session, BTC rallied to a new all-time high of $111,880. Although it has since witnessed a minor pullback to exchange hands at $111,618 at press time, technical readings point to lingering bullish pressure in the markets.

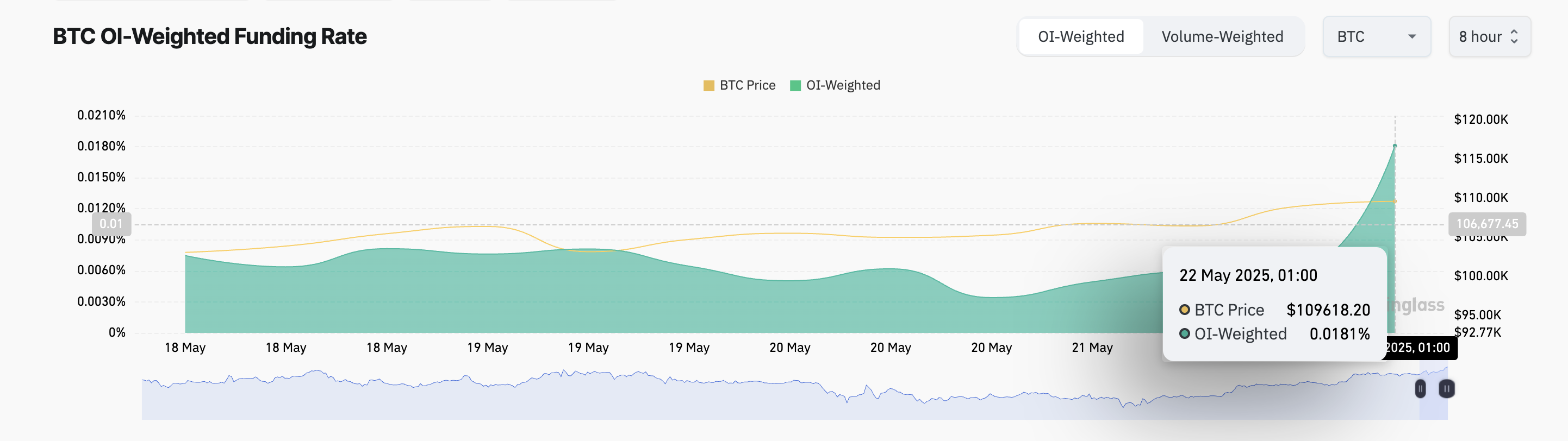

The uptick in price is mirrored in the derivatives market, where demand for long positions has surged. According to Coinglass, BTC’s funding rate currently stands at 0.018%, its single-day highest value since February 22.

The funding rate is a recurring fee paid between traders in perpetual futures markets to keep contract prices aligned with the asset’s spot price. When the funding rate spikes, it indicates that more traders are betting long, signaling heightened bullish sentiment.

However, this also raises the risk of a potential price correction, and options market traders appear to have realized this.

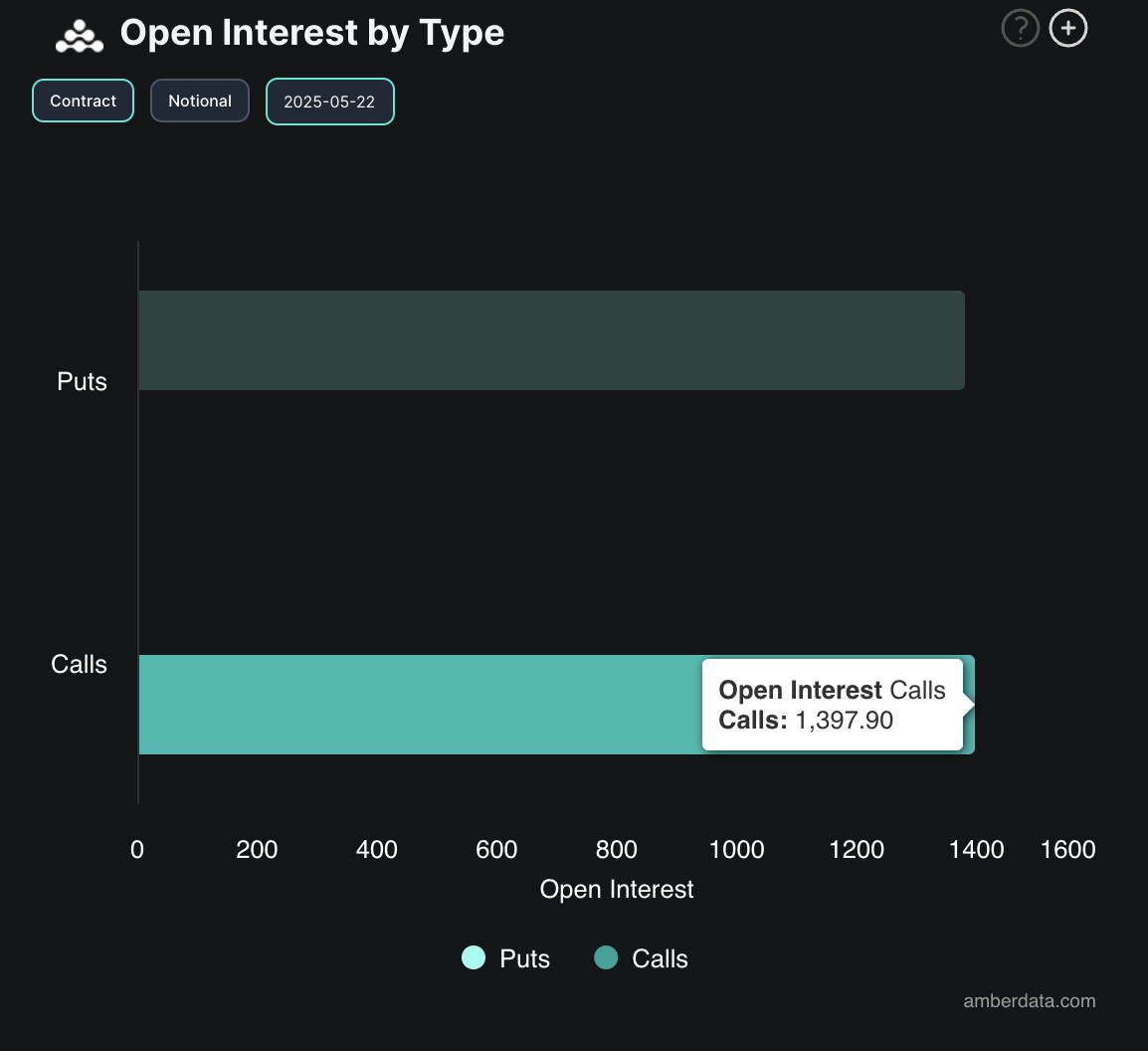

Deribit’s data reveals that BTC options traders maintain a balanced sentiment, with near-equal demand for calls and puts. This reflects cautious optimism, as traders adopt a “wait and see” approach, eager to see whether the coin will sustain its position above $110,000 or if the recent breakout is a bull trap.

Nonetheless, call options — bets that the asset will rise — have a slight edge, pointing to continued upward pressure despite climbing bearish activity.