Bitcoin’s $100,000 Target Remains Feasible

In Brief

- Bitcoin could reach $100,000 as market dynamics and economic indicators align.

- Investor optimism grows with potential Fed rate cuts influencing Bitcoin’s demand.

- Institutional interest and ETF approvals bolster the Bitcoin price’s upward trajectory.

Bitcoin’s potential to hit $100,000 remains a topic of keen interest among investors. Various market dynamics and economic indicators suggest that this ambitious target is still within reach.

Experts share insights on what it will take for Bitcoin to achieve this milestone.

The Path to a $100,0000 Bitcoin

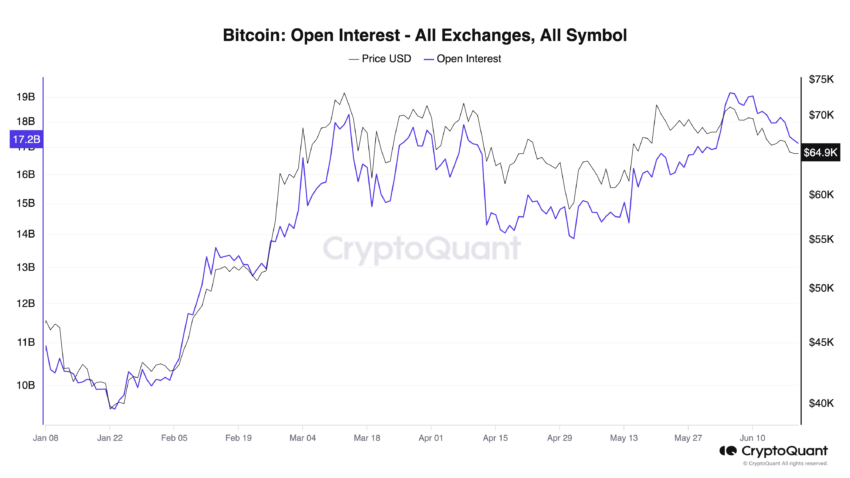

Felix Mohr, co-founder of MohrWolfe, told BeInCrypto about Bitcoin’s potential, emphasizing the growing demand and increasing Open Interest (OI). Recently, Bitcoin futures OI surged by $2.02 billion in just three days.

“This increased buying interest in Bitcoin is no coincidence. Investors have made it clear they anticipate two US Federal Reserve rate cuts by the end of the year,” Mohr explained.

Indeed, investor sentiment is significantly influenced by speculations surrounding the Federal Reserve’s monetary policy. A Reuters poll indicates a potential rate cut in September, although there is a risk of fewer cuts or none at all.

“Nearly two-thirds of economists, 74 of 116, in the May 31-June 5 Reuters poll predicted the first cut in the Fed funds rate to a 5.00%-5.25% range would come in September. That was the same conclusion as last month’s poll, with a similar majority,” reads the Reuters report.

Get to know Godleak

Godleak crypto signal is a service which provide profitable crypto and forex signals for trading. Godleak tried to provide you signals of best crypto vip channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

Join for Free

☟☟☟☟☟

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

Historically, Bitcoin benefits from a bullish stock market, which could be invigorated by Fed rate cuts. However, Federal Reserve Chair Jerome Powell remains cautious and economic indicators further complicate the picture.