What Crypto Whales Are Buying For Potential Gains In January 2026

Chainlink whales added about $8.5 million as LINK fights to reclaim $12.50. Lido whales added roughly $2.28 million while $0.59 remains the breakout line. Aster whales bought over $320,000 as ASTER battles support near $0.65. Year-end usually brings position cuts across crypto. Big wallets and smart money often reduce exposure to secure profits, sit on…

Read more

Cardano Founder Charles Hoskinson Pitches Midnight as a Privacy Layer for Bitcoin and XRP

Charles Hoskinson is positioning Midnight as a cross-chain privacy layer designed to add compliant privacy to networks such as Bitcoin and XRP. He argues the protocol could expand Cardano’s reach, unlock institutional use cases like real-world asset tokenization, and challenge legacy finance. As a result, retail investor’s seculative interest in Midnight’s NIGHT token has surged,…

Read more

Is XRP at Risk of a Breakdown Before 2026 Begins? Three Metrics Hint at Trouble

Retail and 2–3 year holders are selling while price stays range-bound. CMF stays negative and slides toward breakdown-risk trendline. XRP price must defend $1.81 to avoid bearish continuation. XRP is down about 1.6% over the past 24 hours. On the weekly chart, it remains one of the weaker large-cap movers, sitting roughly 16% lower than…

Read more

Bloomberg’s 2026 Outlook Ignored Crypto—But Four Themes Still Matter

Fed independence threatened as Trump appoints new chair in May 2026; weakening dollar could boost Bitcoin demand. AI stocks face correction as enterprise demand lags; resulting selloff could trigger broad risk-off sentiment hitting crypto. Tariff impacts hitting real economy in 2026 may sustain inflation, limiting Fed rate cuts and pressuring crypto. Bloomberg’s year-end Trumponomics podcast…

Read more

Why Retail’s Lack of Interest May No Longer Signal a Market Bottom

Retail participation in crypto continues to fade, with interest weakening into year-end. Some analysts see retail apathy as a bottom signal, others as a cultural shift. Institutional inflows now dominate, reshaping crypto from speculation to infrastructure. Retail participation in the cryptocurrency market has continued to decline throughout this cycle, with interest weakening further as the…

Read more

Multicoin Capital Buys 60 Million Worldcoin (WLD) as Retail Engagement and Price Slide

Multicoin Capital bought 60 million Worldcoin tokens via OTC deal despite recent price weakness. Worldcoin retail interest has fallen sharply, with declining wallets and search trends. Regulatory pressure intensifies as authorities halt operations in multiple countries. Multicoin Capital has reportedly purchased 60 million Worldcoin (WLD) in an over-the-counter transaction with the project’s team, betting on…

Read more

Trump Hints at Samourai Wallet Pardon — Another After CZ, Ulbricht

Trump said he would review Rodriguez’s five-year prison sentence after a reporter raised the Samourai Wallet case. Prosecutors say Rodriguez promoted Bitcoin mixing to criminals and described the service as money laundering for Bitcoin. The case raises questions about potential clemency for Tornado Cash developer Roman Storm, convicted on similar charges. President Donald Trump said…

Read more

XRP ETFs Log One Month of Inflows as BTC, ETH Funds Bleed $4.6B

XRP spot ETFs have recorded 20 consecutive trading days of net inflows since launch, a streak unmatched by any other crypto ETF. Bitcoin and Ethereum ETFs saw combined net outflows of $4.65 billion over the same period, highlighting a stark divergence in investor sentiment. Analysts view XRP ETFs as structural allocation tools rather than tactical…

Read more

Gold Nears ATH Again as Bitcoin Hits Historic Low—Rotation Ahead?

Gold trades at $4,305, just $80 below October’s all-time high, up 64% YTD on rate cut expectations. Bitcoin hovers around $86,000, down 30% from October’s $126,210 peak, as $200M in longs were liquidated Monday. BTC/Gold RSI below 30 historically marked bear market bottoms—analysts anticipate capital rotation from gold to Bitcoin. Gold prices edged higher on…

Read more

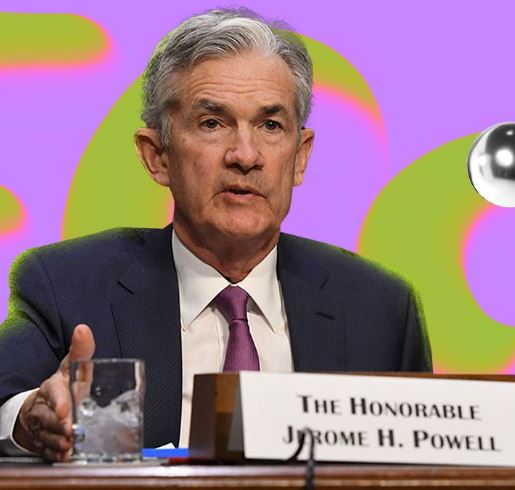

Fed Cuts Rates 25bps, But the Real Shock Is What Comes Next

Fed cuts 25bps as expected, but avoids committing to further easing. Split vote exposes uncertainty over labour softness and inflation stickiness. Guidance now outweighs the cut — January and 2026 path will drive markets. The Federal Reserve has lowered interest rates by 25 basis points to a target range of 3.50%–3.75%, delivering the cut markets…

Read more