Ethereum (ETH) Price Could Smash Through $3,300 Due to These Reasons

In Brief

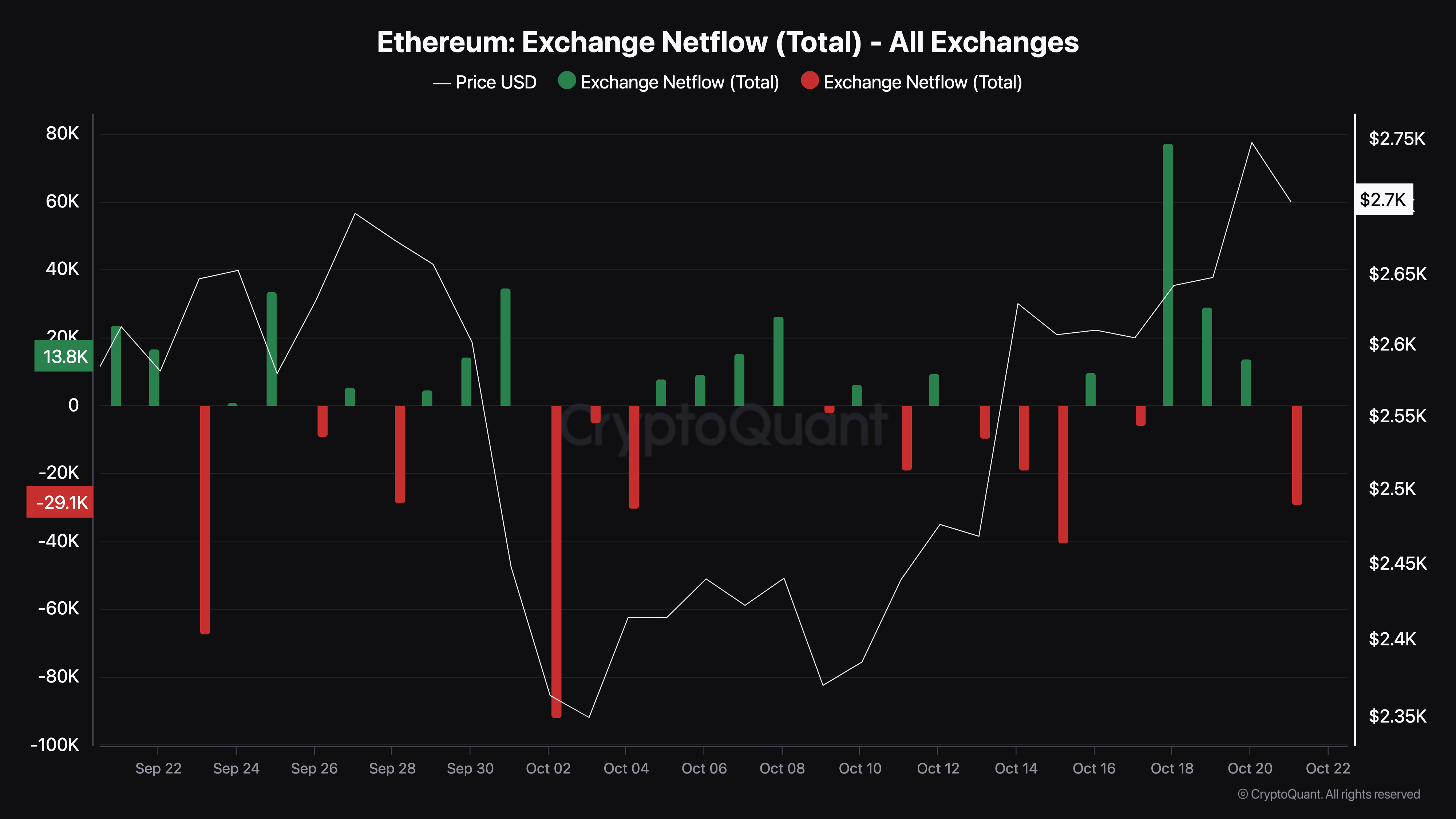

- About $80 million ETH has left exchanges within the last 24 hours, suggesting waning selling pressure.

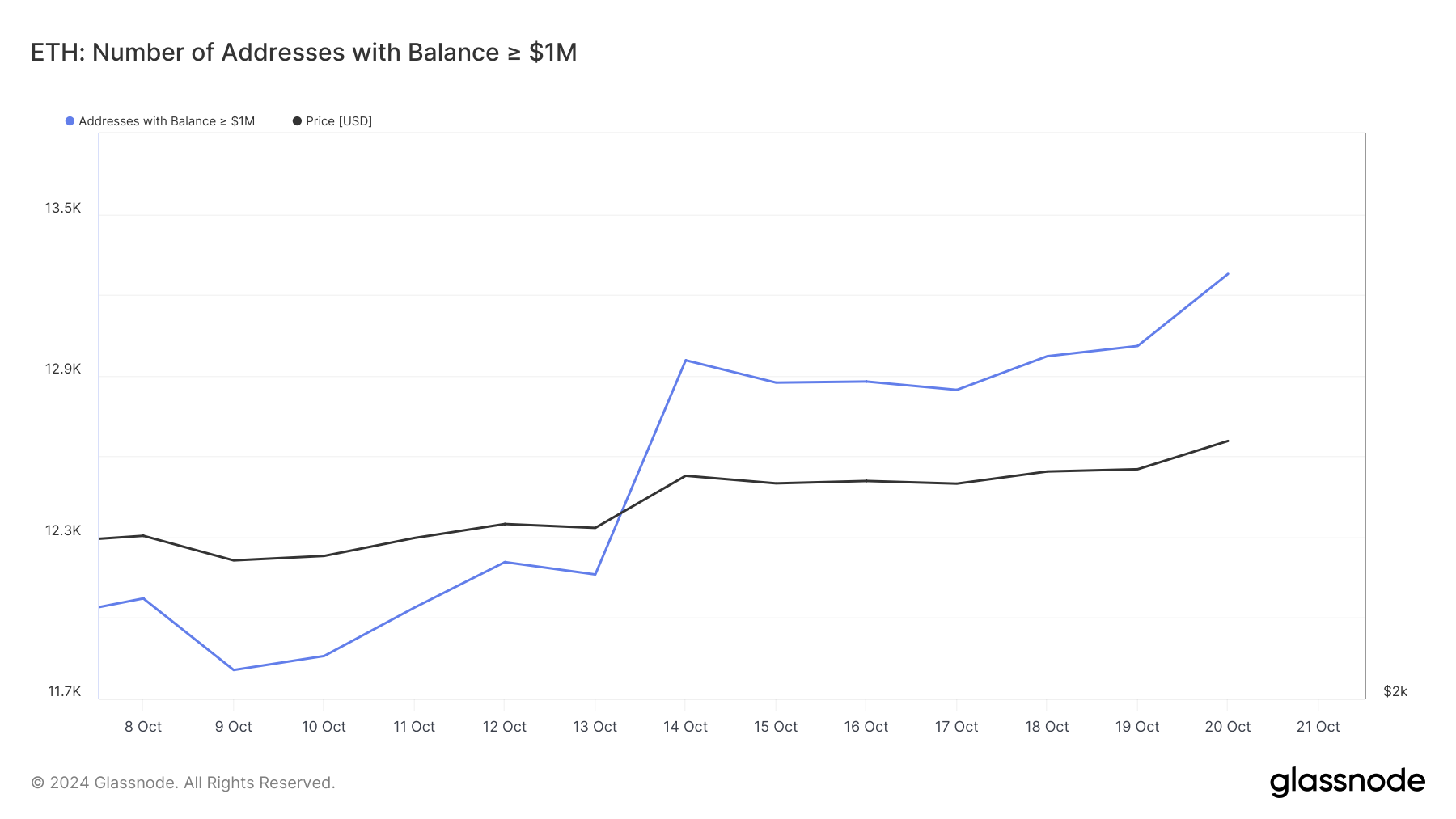

- The number of Ethereum addresses holding at least $1 Million has increased, reinforcing the bias.

- ETH has broken out of a symmetrical triangle, suggesting that the cryptocurrency might rise by 23%.

For the first time since September 27, Ethereum has surged past the $2,700 mark and is showing strong signs of maintaining its upward momentum. About ten days ago, ETH dropped below $2,400, sparking speculation that the cryptocurrency might struggle to break out again.

However, over the past seven days, ETH has surpassed key resistance levels. In this on-chain analysis, reveals how this upward momentum could drive the price even higher.

Ethereum Sees Reduced Selling Pressure

One indicator fueling this prediction is the Ethereum Exchange Netflow, which shows the amount of coins flowing in and out of exchanges. According to CryptoQuant, market participants have taken 29,378 ETH off exchanges as of this writing.

From a spot trading perspective, high values typically signal increased selling pressure. However, with approximately $80 million being removed, it suggests that ETH may not face significant selling pressure in the near term.

On the derivatives side, the decline points to low volatility, indicating that traders with open positions are less likely to face liquidations. When combined, this current condition could be bullish for Ethereum’s price.

Another metric supporting the bullish outlook is the number of addresses holding ETH valued at $1 million or more. When this metric rises, it indicates that HODLers are accumulating more coins, reflecting bullish behavior. Conversely, a decline suggests that long-term holders are cashing out, typically signaling bearish sentiment

Based on Glassnode’s data, the number of addresses holding ETH worth $1 million and above has increased, suggesting that Ethereum’s price could avoid going through another drawdown.

Crypto analyst and founder of MN Consultancy Michaël van de Poppe shares a similar view. However, in his post, van de Poppe noted that ETH needs to rise above $2,770 to have any chance of surpassing $3,000.

“Ethereum might finally reverse. Breaking through the crucial resistance at $2,770 would be great. If that happens, the next target is $3,200, ” the analyst emphasized.

Get to know Godleak

Godleak crypto signal is a service which provide profitable crypto and forex signals for trading. Godleak tried to provide you signals of best crypto vip channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

Join for Free

☟☟☟☟☟

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

ETH Price Prediction: Bulls Must Defend $2,689 Support

A look at the daily chart shows that Ethereum’s price has broken out of a symmetrical triangle. For context, a symmetrical triangle is a chart pattern defined by two converging trendlines that connect a series of sequential peaks and troughs.

Usually, when an asset’s price breaks below the triangle, the asset’s price tends to fall further. For ETH, it is the other way around, suggesting that the value could continue climbing. But for that to happen, bulls have to defend the $2.689 support

Beyond that, buying pressure needs to increase so the price can climb above the resistance at $2,989. If that is the case, ETH’s price could rally to $3,316.

However, this thesis could be rendered null and void if ETH falls below the aforementioned support line. In that scenario, the price could tumble to $2,471.