Grayscale Opens XRP Trust Trading, 21Shares Applies for ETF

In Brief

- Grayscale launched trading on its XRP Trust, while 21Shares formally applied for an XRP ETF, marking major developments.

- Grayscale’s XRP Trust offers early access but may lose appeal if dedicated XRP ETFs gain approval and market traction.

- SEC ambiguity around XRP ETFs persists, while firms like 21Shares and Grayscale seek to establish early market positions.

- promo

Two prominent ETF issuers advanced their XRP-based asset initiatives today. Grayscale launched trading on its XRP Trust fund, while 21Shares submitted an official application for an XRP ETF.

While Grayscale’s Trust fund holds potential for eventual conversion into an ETF, its long-term customer appeal remains uncertain.

Get to know Godleak

Godleak crypto signal is a service which provide profitable crypto and forex signals for trading. Godleak tried to provide you signals of best crypto vip channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

Join for Free

☟☟☟☟☟

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

The XRP ETF Race

Grayscale announced that its XRP Trust is now open to eligible accredited investors. Launched two months ago, this trust is seen as a possible precursor to an ETF. Grayscale previously converted its Bitcoin trust into an ETF after securing regulatory approval and is currently working to convert another fund into an ETF.

“Grayscale XRP Trust (the “Trust”) is one of the first securities solely invested in and deriving value from the price of XRP… avoiding the challenges of buying, storing, and safekeeping XRP directly. Shares of the Trust are designed to track the XRP market price,” the company claimed on its website.

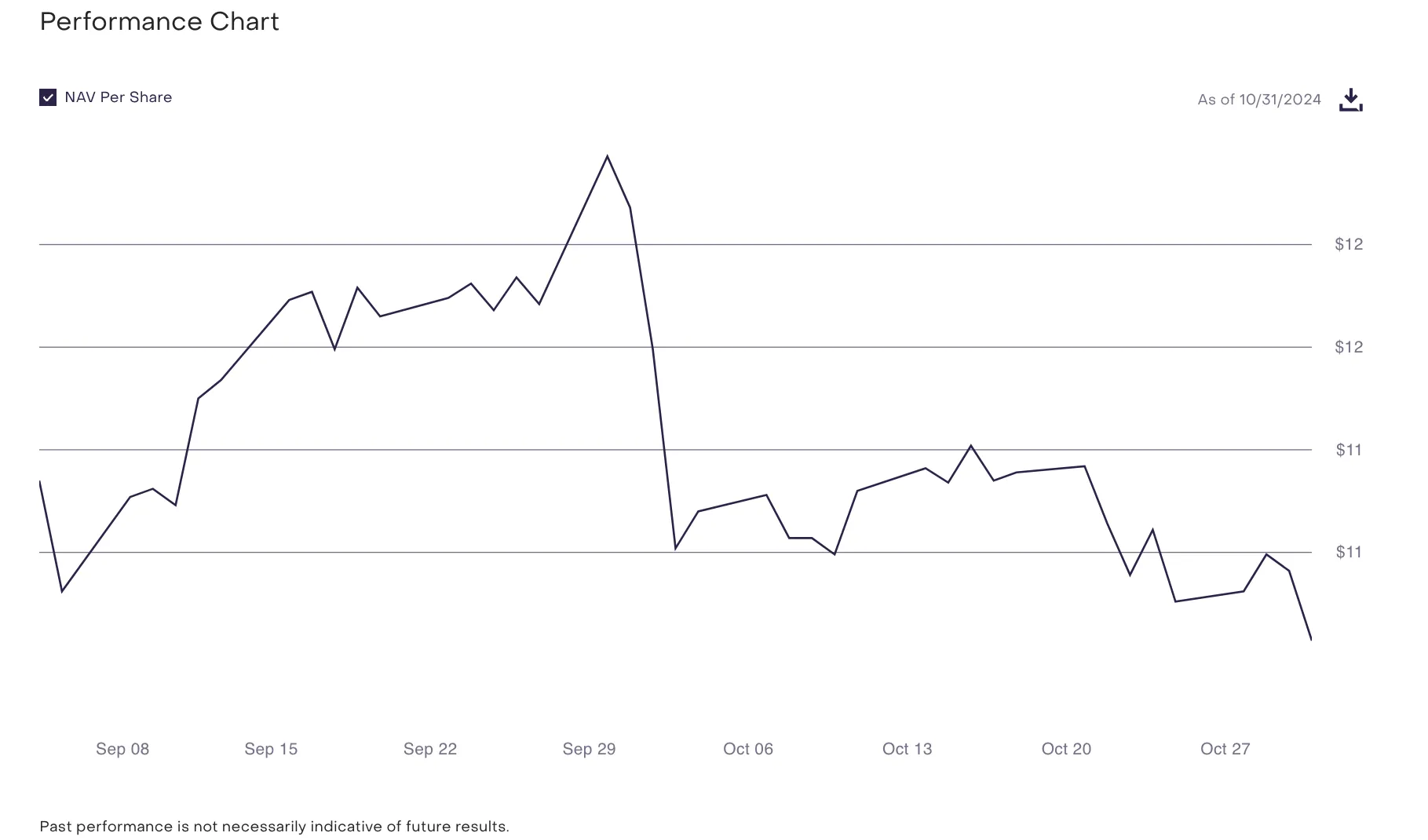

The possibility of an XRP ETF is growing in the crypto space. Ripple’s CEO called eventual regulatory approval “inevitable”, and several firms have already filed their own petitions. Grayscale’s non-ETF trust strategy has been reliable in the past, allowing for early profits. However, this looser structure also has downsides: the XRP Trust’s price actually declined when trading began.

Although Grayscale’s Bitcoin Trust (GBTC) was an early leader in the ETF market, it quickly lost ground to younger competitors. The company even went so far as to launch a second Bitcoin-based ETF, attempting to recover this market share. Grayscale’s pre-ETF trust fund strategy may allow early market access, but its customers may abandon it for a dedicated ETF product.

If the SEC does approve an XRP ETF in the near future, Grayscale will have plenty of competitors. According to filed documents, investment firm 21Shares is also entering the race. 21Shares is already a Bitcoin ETF issuer and has also petitioned for a Solana ETF. The race is heating up, and it could transform the face of Ripple.

Ultimately, the SEC has been very quiet about the likelihood of approving these products. Once the Commission officially begins confirming or rejecting these applications, they’re locked into a series of deadlines. In other words, they will either have to move the efforts along or explicitly block them. For now, this ambiguity is still sustainable, and it doesn’t show signs of moving.