Hong Kong’s regulatory progress and China’s hint of lifting the crypto ban

Briefly

- Hong Kong’s progress in developing a stablecoin regulatory framework suggests a shift in China’s crypto policy.

- Even Coinbase and other international cryptocurrency exchanges were invited to register in Hong Kong by a legislator.

- Central area China’s white paper on Web 3.0 development further recommends a likely lift of the Chinese prohibition on crypto.

China has begun sending signals that it might reconsider its crypto ban, which is a surprising turn of events. thereby offering hope for a future crypto market that could be lucrative.

The crypto ban might finally be lifted, according to recent regulatory developments in Hong Kong and technological advancements in mainland China.

A Brief History of China’s Crypto Ban

China’s relationship with the cryptographic money industry has been turbulent starting around 2013, when the nation initially forced severe limitations. The primary boycott came in December of that year when Individuals’ Bank of China (PBoC) and other monetary guard dogs denied banks from dealing with exchanges connected with Bitcoin.

The term “special virtual commodity” was applied to Bitcoin. It was argued by regulators that it did not have the legal backing to function as a currency. As a result, it was regarded as a potential route for cash laundering.

In 2017, China found a way further ways to keep cash from streaming out of the nation wrongfully. The PBoC began an investigation into cryptocurrency exchanges in January of that year, focusing on forex management and money laundering prevention.

The discoveries prompted the choice to boycott beginning coin contributions (ICOs) in September. The PBoC then mandated that investors receive their invested funds back.

It likewise restricted monetary establishments and non-bank installment organizations from offering types of assistance that took special care of token-based gathering pledges exercises and gave a mandate driving crypto trades to close down intentionally.

In the years that followed, the crackdown was focused on Bitcoin mining in 2019. Due to its impact on the environment, the National Development and Reform Commission (NDRC) deemed it an “undesirable” industry.

Since China was home to more than half of the world’s Bitcoin mining power and a significant portion of Bitcoin mining rigs, this classification caused panic.

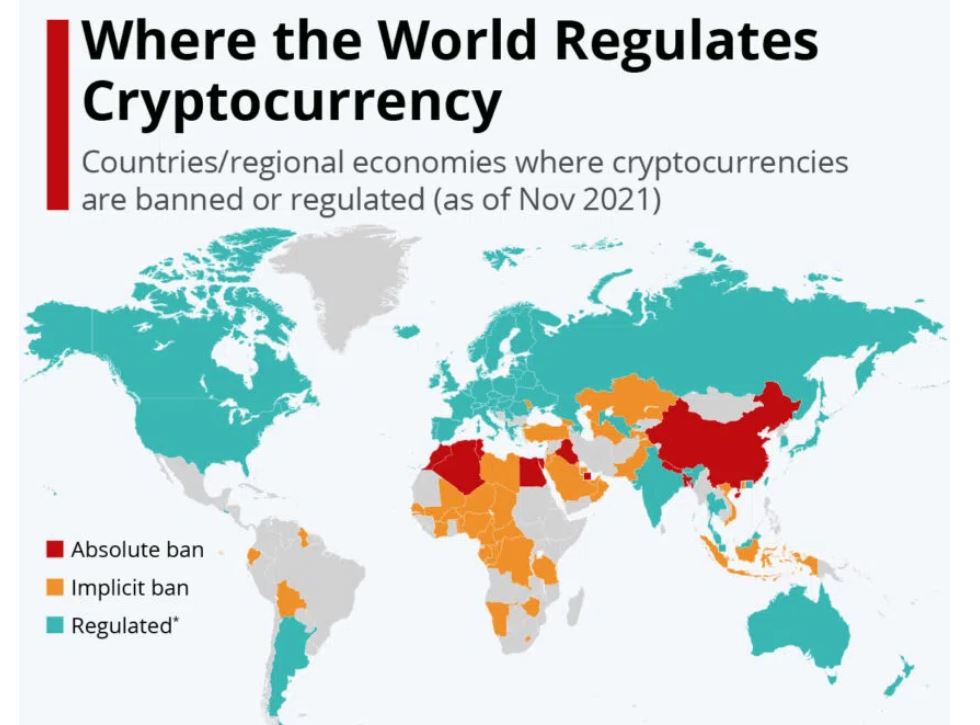

Over a hundred foreign websites that offered crypto exchange services were blocked by the government in 2020. China implemented this series of restrictions in 2021, when it completely outlawed cryptocurrency trading and mining. It cited Bitcoin’s high energy consumption and threat to the nation’s environmental objectives.

The global crypto economy was significantly impacted when Bitcoin miners were forced to shut down or relocate to other crypto-friendly nations.

A Green Light to Crypto Through Regulation

It now appears that China is subtly altering its cryptocurrency policy. Hong Kong, a city that has long served as China’s sandbox, is moving forward with new regulations that may finally lift the crypto ban.

In fact, the Hong Kong Monetary Authority (HKMA) is making significant progress in developing a regulatory framework for stablecoins—cryptocurrencies whose value is based on traditional financial assets.

A significant development is the HKMA’s announcement of a stablecoin regulatory regime by 2024. Especially in light of the fact that cryptocurrency trading is still illegal in a region that has traditionally acted in opposition to mainland China.

Amid growing uncertainty and regulatory challenges in the US, the crypto community worldwide applauds Hong Kong’s steps toward policy clarification for the new asset class.

“A lot of the Chinese capital is looking for smarter, safer ways to invest [and] being in Hong Kong naturally makes more sense than anywhere else,” said Henry Liu, Chief Executive Officer at BTSE.

Additionally, Hong Kong recently implemented a new crypto regulatory framework that mandates the licensing of exchanges. Its objective is to make it possible for retail investors to trade cryptocurrencies like Ethereum and Bitcoin. Even Johnny Ng, a member of the Legislative Council in Hong Kong, encouraged cryptocurrency exchanges, such as Coinbase, to apply for and register in the region.

“I hereby offer an invitation to welcome all global virtual asset trading operators including Coinbase to come to HK for application of official trading platforms and further development plans,” said Ng.

With the US Protections and Trade Commission (SEC) taking action against crypto trades, this greeting shows Hong Kong’s preparation to embrace crypto firms meaning to serve retail clients in the country.

Get to know Godleak

Godleak crypto signal is a service which comprise of a professional team. They tried to provide you signals of best crypto channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

Embracing Blockchain Technology and Web3

Additionally, a Chinese financial institution known as BOCI recently issued digitally structured notes totaling CNH 200 million. It was the company’s first issuance of tokenized securities in Hong Kong.

UBS initiated the operation and offered it to its Asia-Pacific clients. Following that, displaying brand-new steps in blockchain types and applicable law. Also, it meant that regulated securities were successfully added to a public blockchain.

“We are driving the simplification of digital asset markets and products, for customers in Asia Pacific through the development of blockchain-based digital structured products… We are encouraged by the evolution of Hong Kong’s digital economy and are committed to promoting the digital transformation and innovative development of Hong Kong’s financial industry,” said Ying Wang, Deputy Chief Executive Officer at BOC.

While Hong Kong’s inviting position and administrative improvements are praiseworthy, the buzz around lifting China’s crypto boycott isn’t only a result of these advances.

A white paper on Internet 3.0 innovation and development in mainland China was published by Beijing. It included blockchain innovation as a key foundation, featuring a possible change in China’s crypto position.

The annual investment that is planned for Chaoyang District is at least 100 million yuan. Further evidence of a crypto-friendly future is provided by the objective of assisting in the development of the Internet 3.0 industrial ecosystem.

Changes in Policy Point to Lifting the Ban on Crypto

It is essential to keep in mind that lifting a crypto ban of the magnitude of China’s will require more than just a change in regulations.

It will require a complete overhaul of the ecosystem, which will include enhanced due diligence procedures, stringent cybersecurity standards, and safer asset custody procedures. The meticulousness required is exemplified by the plans of the Hong Kong Securities and Futures Commission (SFC) to allow licensed platforms to serve retail investors under specific guidelines.

These developments raise the possibility of a relaxation of China’s enduring crypto prohibition. The path to a full lift continues to be long and difficult. Nonetheless, crypto enthusiasts and investors alike can take heart in these encouraging signs.

In anticipation of a potential game-changer from the East, the crypto market waits. Particularly in light of the fact that mainland China and Hong Kong are still working to improve their regulatory frameworks and embrace technological innovation.