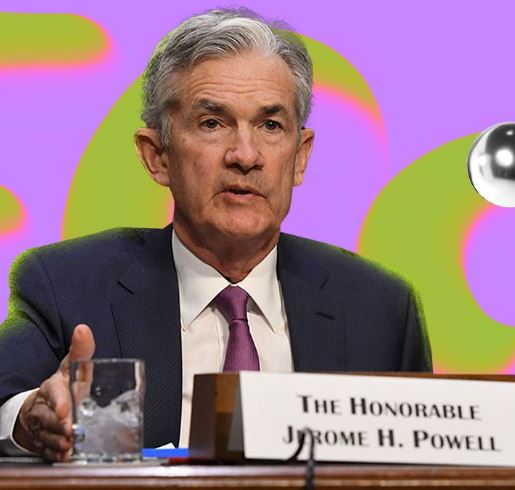

Interest rates are raised by the Fed by 25 basis points, with a rate hike pause likely

- In a nutshell, Jerome Powell, chair of the U.S. Federal Reserve, announced that the bank had decided to raise interest rates by an additional 0.25%.

- As a result of the failure of several banks, according to Powell, there will likely be a pause in rate increases.

- Following the Fed announcement, the speech by U.S. Treasury Secretary Janet Yellen caused Bitcoin to drop under $27,500.

The S&P 500 increased by 0.3% and the Dow by one-tenth of a percent as a result of the Federal Reserve raising the federal funds rate by 25 basis points.

With the most recent increase, the interest rate is now between 4.75% and 5%. The Fed justified this move by stating that it expected spending and economic growth to slow due to the failure of several U.S. banks.

Fed Changes ‘Ongoing Increases’ Narrative

Following the announcement, Bitcoin slightly increased from $28,400 to $28,585, while ETH increased from $1799.21 to $1,811.01.

Chairman Jerome Powell noted that the central bank changed its view on the swiftness and aggressivity of future increases during a speech before Congress earlier this month. The phrase “ongoing increases” should be changed to “additional policy firming,” which implies that the central bank may decide to pause increases at upcoming meetings.

Additionally, the Fed anticipated slower U.S. economic growth in 2023.

Notably, the Fed’s preferred inflation indicator for February 2023, the U.S. Personal Consumption Expenditure Index, was not taken into account when deciding on the interest rate. Release day for the PCE is March 31, 2023.

Powell suggested that a tight labor market in the United States might lead to continued aggressive monetary policy tightening that would raise the central bank’s terminal rate in his Semiannual Monetary Policy Report to Congress on March 8, 2023. The interest rate that would bring inflation to the Fed’s 2% target is known as the terminal rate.

Get to know Godleak

Godleak crypto signal is a service which comprise of a professional team. They tried to provide you signals of best crypto channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

Bank Failures Tie Hands of Federal Reserve

Four consecutive increases of 0.75% by the Federal Reserve, which began raising interest rates in the U.S. about a year ago, sparked concerns about an impending recession.

Powell claimed that the scale of the 25 basis point increase was also influenced by the recent failures of Silicon Valley and Signature Bank.

In the midst of a wave of withdrawals that put the companies’ risk management to the test, the Federal Deposit Insurance Corporation placed both banks into receivership earlier this month.

Janet Yellen, the U.S. Treasury Secretary, declared that the FDIC would not set a higher limit to backstop bank deposits shortly after Powell’s press conference.

Following Yellen’s remarks, Bitcoin fell to about $27,000 before rising to $27,505. ETH dropped to $1,728 before rising to $1,747.