Vitalik Buterin Defends Ethereum’s Transition to Proof-of-Stake (PoS)

In Brief

- Vitalik Buterin has responded to community concerns regarding the network’s transition from PoW to PoS.

- Buterin emphasized the necessity and benefits of this shift, citing concerns over PoW’s centralization.

- Despite Ethereum’s successful transition to PoS, regulatory scrutiny, particularly from the SEC, persists.

Ethereum co-founder Vitalik Buterin has responded to community concerns about the network’s transitioning from Proof-of-Work (PoW) to Proof-of-Stake (PoS).

Over the past week, Ethereum’s PoS transition faced scrutiny from community members, particularly amidst concerns it prompted increased scrutiny by US regulators.

Was Ethereum’s Transition to PoS a Mistake?

Since its launch in July 2015, Ethereum operated on a PoW consensus mechanism similar to Bitcoin. In PoW, participants compete to solve cryptographic algorithms, requiring significant computational power and energy to validate each block in the blockchain.

Concerns over the environmental impact of PoW cryptocurrencies prompted authorities in various countries to advocate for their ban in favor of more sustainable alternatives.

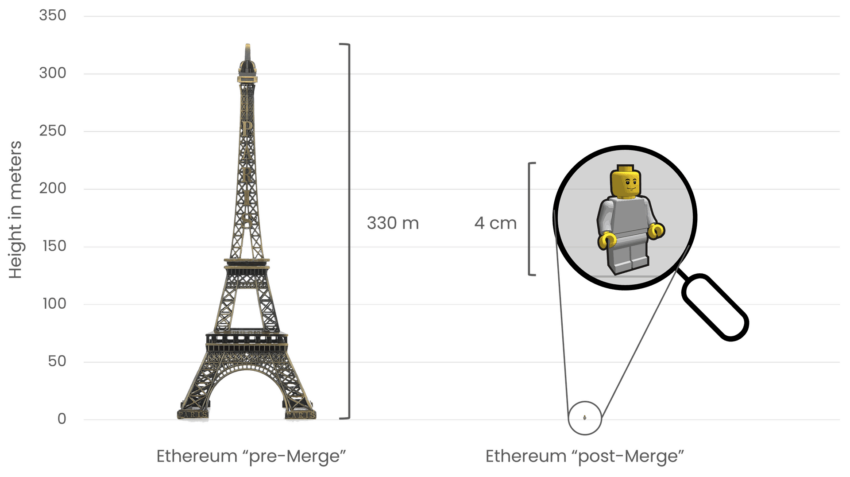

In September 2022, Ethereum developers initiated a major transition known as “The Merge,” moving towards a PoS infrastructure. This monumental shift replaced miners with stakers, addressing the environmental concerns and aligning with Ethereum’s long-term objectives.

Vitalik Buterin stressed the importance of this transition, highlighting PoW’s centralization and its temporary nature before PoS implementation.

“PoW was also quite centralized. It was just not talked about as much, because everyone knew it was only a temporary stage until PoS. And that doesn’t even get into how we probably mostly avoided ASICs only because the upcoming PoS switch meant no incentive to build them,” Buterin said.

Get to know Godleak

Godleak crypto signal is a service which provide profitable crypto and forex signals for trading. Godleak tried to provide you signals of best crypto vip channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

Join for Free

☟☟☟☟☟

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

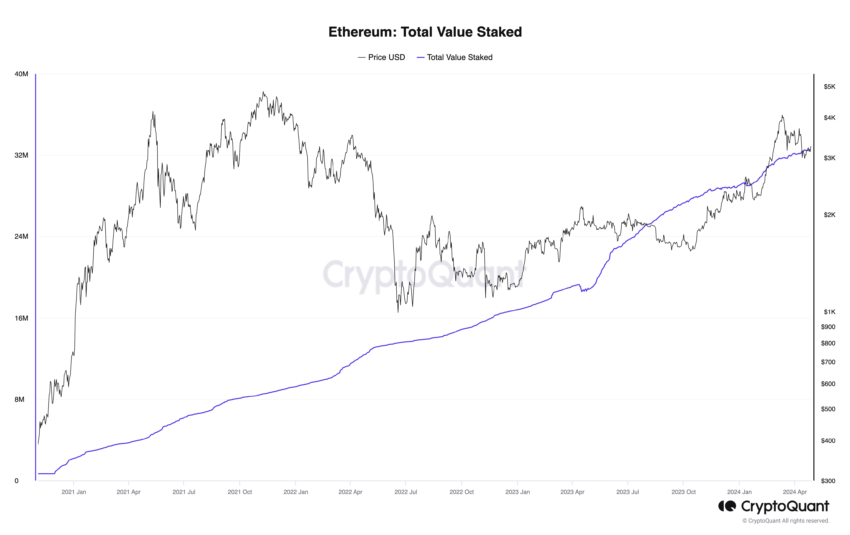

Since completing the transition to a PoS chain, Ethereum has witnessed a surge in validator numbers and staking demand. More than 25% of ETH’s circulating supply has been staked, enhancing network security and providing yields for participants.

However, Ethereum staking has drawn scrutiny from the Securities and Exchange Commission (SEC). SEC Chair Gary Gensler suggested that PoW cryptocurrencies allowing staking might meet the criteria for securities under the Howey test.

Still, a Consensys spokesperson told BeInCrypto that Ethereum’s transition to PoS has nothing to do with the SEC’s decision to investigate the Ethereum Foundation.

“Nothing about Proof-of-Stake itself versus Proof-of-Work would make Ethereum a security. I think really that’s just grabbing at some explanation for the SEC as to why they have flip-flopped on the question of Ethereum because, of course, there’s the famous speech in 2018, where director Hinman said that Ethereum wasn’t a security,” the Consensys spokesperson said.

The uncertainty surrounding Ethereum’s regulatory status remains pertinent, impacting compliance efforts for entities dealing with ETH.