Worldcoin Investors Lose $5.58 Billion in Profits as Price Falls 18%

In Brief

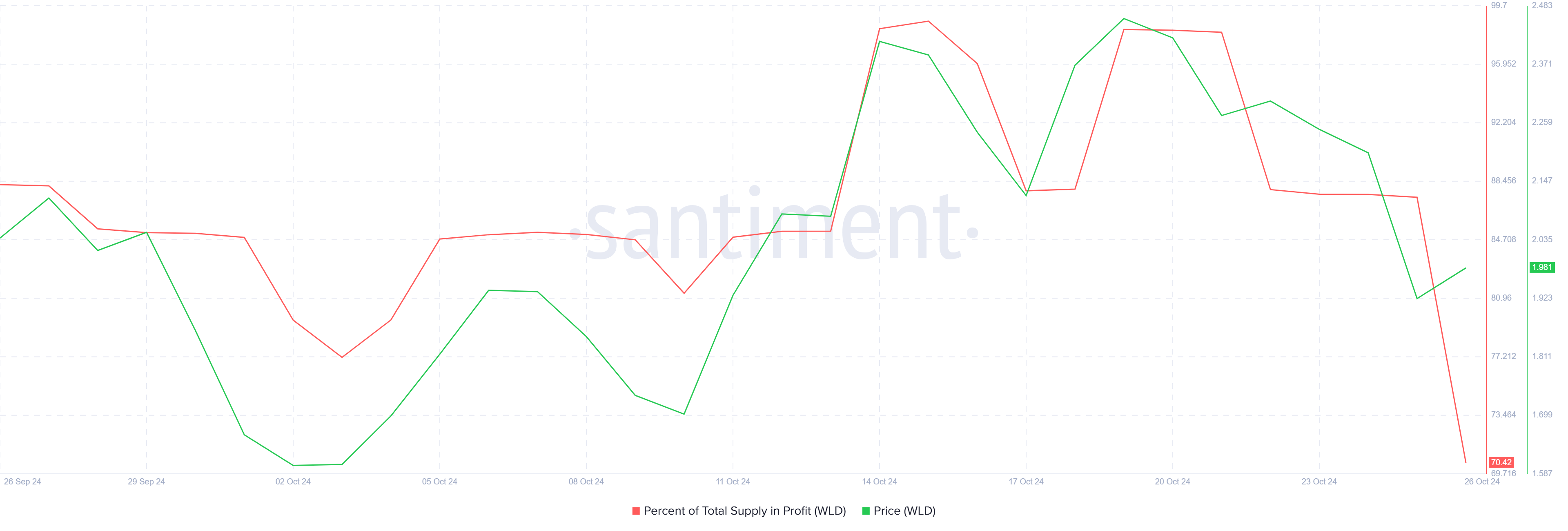

- Worldcoin dropped 19%, reducing the profitable supply from 87% to 70%, impacting investor confidence and sentiment.

- GIOM data shows $5.58 billion in WLD turned unprofitable after an 18% drawdown, highlighting market sensitivity to price shifts.

- WLD needs to reclaim $2.11 support for recovery; failing this, it risks falling to $1.74, further eroding investor optimism.

Worldcoin’s price has been on an upward trajectory since early September, pushing WLD up to $2.46 and sparking optimism among investors. However, the recent drawdown has dampened this sentiment, with many investors facing significant losses and hoping for a recovery.

As the price dipped, Worldcoin holders have seen their profits slip, leading to widespread anticipation of a turnaround.

Worldcoin Investors’ Losses Mount

In the last 24 hours, Worldcoin’s price fell by nearly 19%, hitting an intra-day low that affected market sentiment. This sharp decline saw the total supply in profit drop from 87% to 70%, marking a substantial decrease in profitable holdings. The 17% drop translates to 97.36 million WLD, valued at over $194 million, moving from profit to loss in a single trading day.

This swift downturn has understandably shaken investor confidence. As more holdings fall into loss territory, it highlights a potential tipping point where investor optimism is replaced by caution.

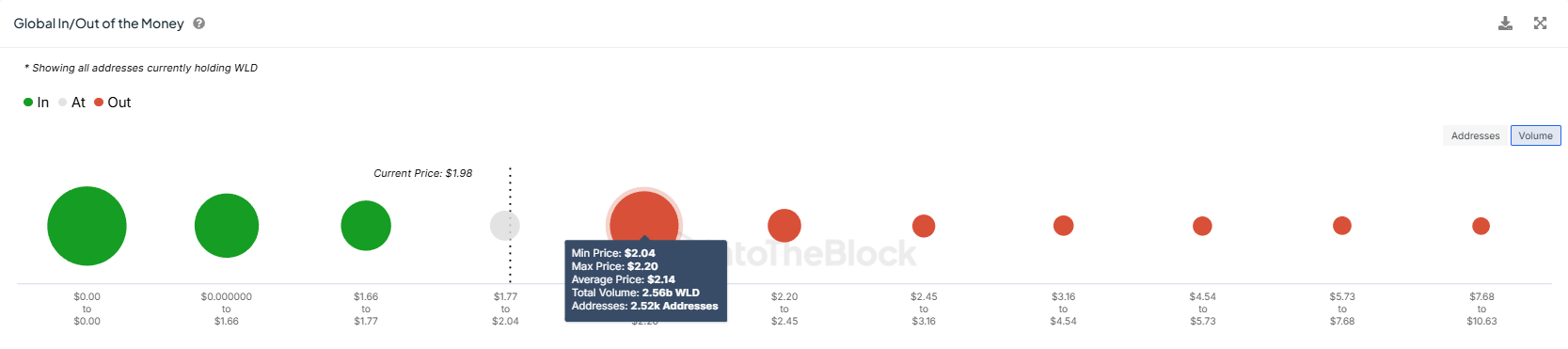

On a macro level, Worldcoin’s trajectory has further hurdles. The Global In/Out of the Money (GIOM) data reveals that approximately 2.79 billion WLD, valued at over $5.58 billion, lost profitability over the past week due to the 18% drawdown.

This supply was bought by WLD holders when the altcoin was trading between $2.04 and $2.45. Thus, only when Worldcoin’s price makes it back to $2.46 can the supply become profitable again, and a breach of this resistance will secure the gains.

Get to know Godleak

Godleak crypto signal is a service which provide profitable crypto and forex signals for trading. Godleak tried to provide you signals of best crypto vip channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

Join for Free

☟☟☟☟☟

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

WLD Price Prediction: Bringing Profits Back

Worldcoin’s price dropped by 18% this week, falling from $2.46 to $1.99 at the time of writing. This setback is notable because Worldcoin’s ongoing uptrend prior to the decline had indicated the potential for reaching $3.00, which would have marked a 22% gain. This upward potential now seems uncertain as Worldcoin faces resistance levels.

The 18% drop has left investors hoping for a recovery to the $2.46 level to regain their losses. Testing $2.11 as support is crucial, as establishing this base could enable a price rise, potentially restoring some of the lost confidence among WLD holders.

However, if Worldcoin fails to breach the $2.11 resistance, a further drop to $1.74 could be likely. Such a decline would extend investor losses and reduce optimism about recouping profits, potentially undermining sentiment and prompting more conservative positioning in the market.