XRP Price’s 18% Crash Recovery in Peril as Bullish Strength Fades

In Brief

- XRP faces resistance at $0.55 and must hold the $0.52 support level to maintain a recovery path amid waning bullish sentiment.

- High long position liquidations and RSI below 50 reflect weakening bullish momentum, which may limit XRP’s upward potential.

- Breaking $0.55 and surpassing the 50% Fibonacci level is crucial for XRP to approach $0.60 and counter its bearish-neutral outlook.

XRP price has recently faced considerable challenges, struggling to breach the critical resistance at $0.55. Despite attempts at rising again, the asset dropped below the essential support level of $0.52, casting doubts on a smooth path to recovery.

The current momentum hints at potential difficulties for XRP’s return to higher levels, making a rise to $0.60 questionable.

XRP Needs Bulls

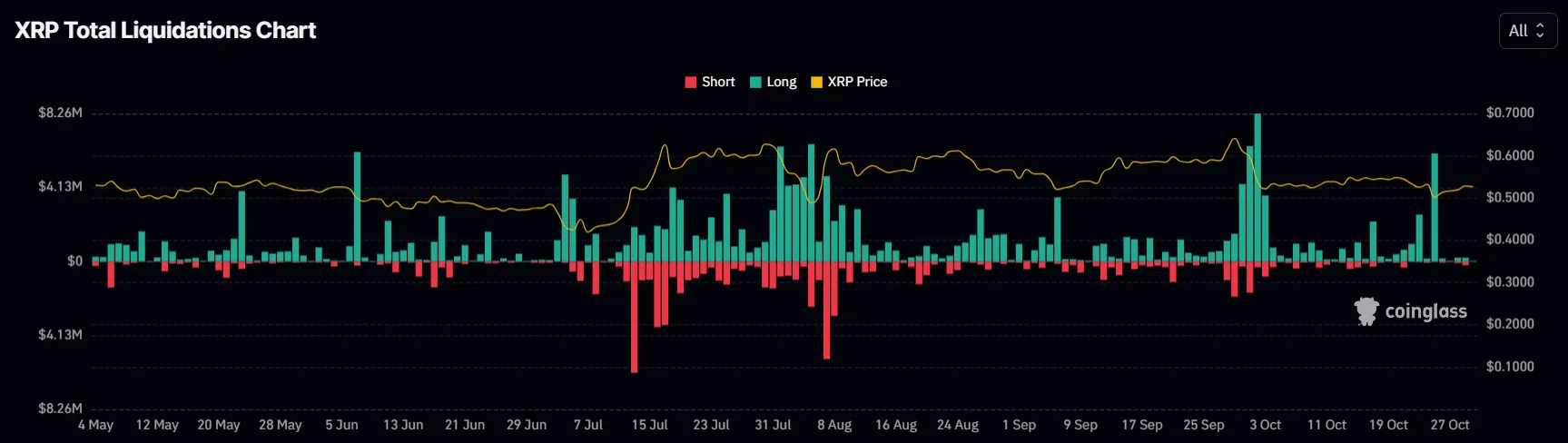

The sentiment around XRP is currently impacted by a high volume of liquidations dominated by long contract holders. These long liquidations reflect uncertainty among traders who had initially anticipated a price increase. However, XRP’s lack of growth and occasional sharp price declines have contributed to a wave of long liquidations, with investors scaling back their positions. This trend adds downward pressure on XRP and suggests that optimism among bulls may be waning.

As more long positions are liquidated, bullish sentiment may weaken, potentially deterring new buying activity. This shift in sentiment poses a risk to XRP’s ability to rally effectively.

XRP’s macro momentum reflects this sentiment shift, as seen in technical indicators like the Relative Strength Index (RSI). The RSI currently sits below the neutral line of 50.0, indicating a lack of bullish momentum.

Get to know Godleak

Godleak crypto signal is a service which provide profitable crypto and forex signals for trading. Godleak tried to provide you signals of best crypto vip channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

Join for Free

☟☟☟☟☟

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

Throughout October, XRP attempted multiple rallies but consistently failed to push the RSI into positive territory, highlighting a struggle to establish sustained upward momentum. This failure suggests fading enthusiasm for bullish gains, which could deter further upward movement.

XRP Price Prediction: Taking Back Support

XRP has shown a slight recovery in the past week, reaching $0.52, though it’s barely holding above the 38.2% Fibonacci Retracement level at this price. Reclaiming $0.52 as a solid support floor is essential for XRP to continue its upward trajectory. Without stability at this level, a recovery could be difficult to maintain.

If XRP successfully holds above $0.52, it could approach $0.55; however, it may struggle to breach this barrier due to a lack of strong bullish momentum. Historical trends suggest XRP is likely to consolidate below this level rather than surpass it, given its current market conditions.

For XRP to negate this bearish-neutral outlook, it would need to break past the 50% Fibonacci Retracement line at $0.55 and aim for $0.59. Successfully crossing this line could push XRP toward the $0.60 mark, offering a more favorable outlook and signaling potential resilience in the face of recent challenges.