Major SUI Liquidations Loom as Price Breaks 2-Week Consolidation

In Brief

- SUI price surges 10%, approaching a breakout with a key resistance at $4.35; potential $25 million in liquidations could trigger a price surge.

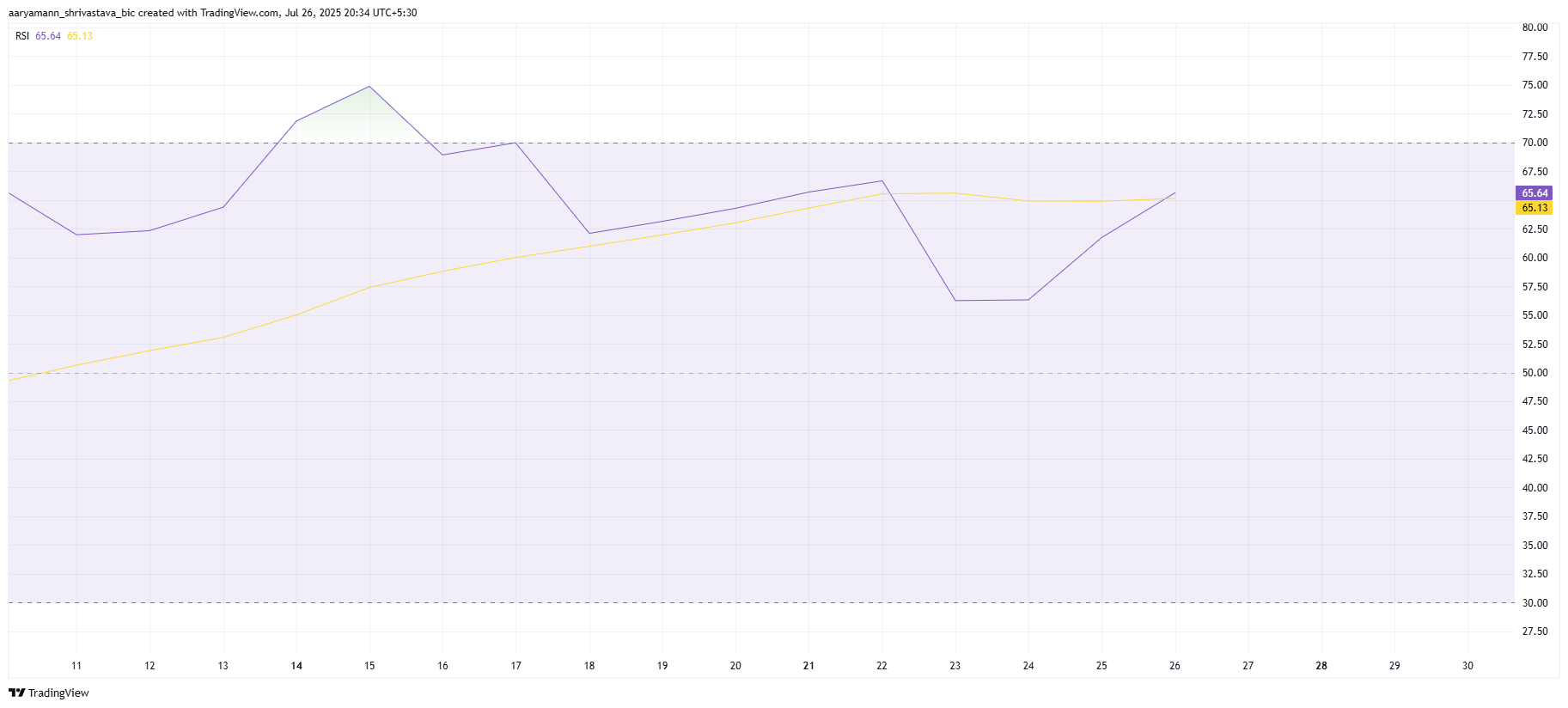

- The RSI remains in the bullish zone, suggesting further upward momentum if market conditions remain favorable.

- SUI is currently trading at $4.13; securing support at $4.12 is crucial to targeting $4.35, while a drop below $3.93 could invalidate the bullish outlook.

SUI price has experienced a sharp surge in the last 24 hours, pushing the altcoin toward a potential breakout.

The recent rally, coupled with favorable broader market conditions, has sparked optimism for a price move to new highs. The altcoin is inching closer to breaking out after a period of consolidation.

Sui is Building Momentum

The Relative Strength Index (RSI) for SUI remains in the bullish zone, suggesting that the altcoin’s upward momentum is strong. The RSI has not yet reached overbought territory, indicating that there is still room for further growth.

This signals that SUI could continue climbing as investor confidence grows.

The healthy position of the RSI supports the view that the price of SUI can maintain its bullish trajectory. The ongoing positive momentum suggests that the altcoin has enough strength to push through the resistance levels ahead, particularly if market conditions remain favorable.

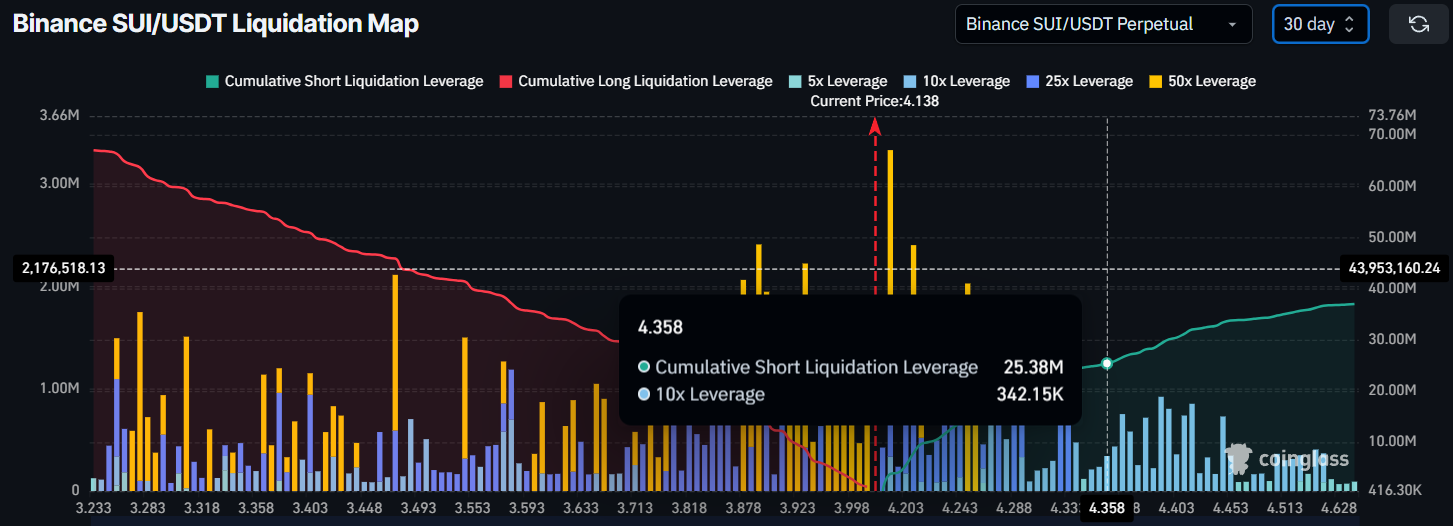

While the market sentiment appears bullish, SUI faces the threat of massive liquidations. The liquidation map reveals that approximately $25 million in short contracts will likely be triggered if the price reaches $4.35.

This would create significant buying pressure, contributing to a potential surge in price.

The liquidation of short positions is generally viewed as a positive factor for the asset’s price, as it leads to increased demand. The absence of short contracts would help maintain bullish sentiment around SUI, as the market would need to push against fewer sell orders. This sets the stage for a potential breakout.

Get to know Godleak

Godleak crypto signal is a service which provide profitable crypto and forex signals for trading. Godleak tried to provide you signals of best crypto vip channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

Join for Free

☟☟☟☟☟

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

SUI Price Is Breaking Out

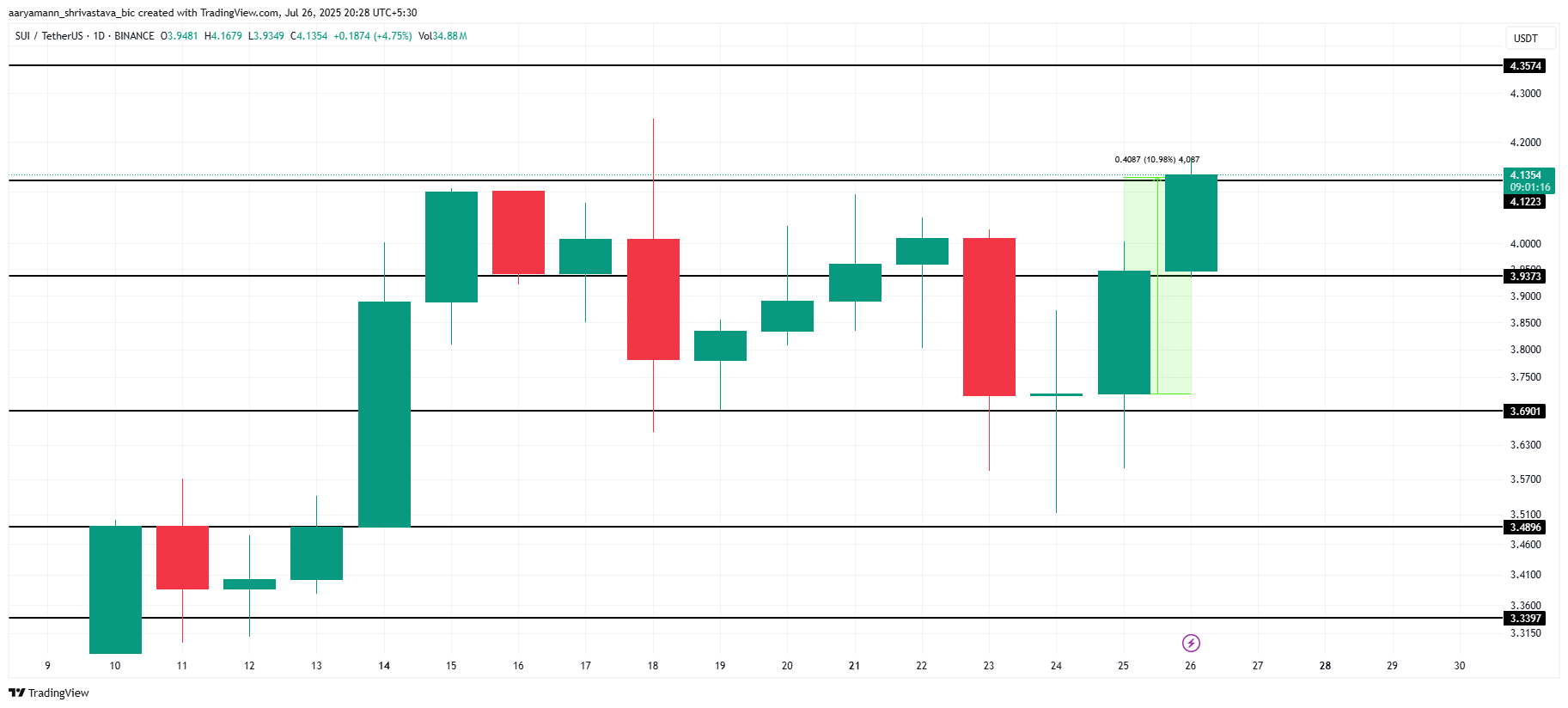

SUI is currently trading at $4.13, attempting to secure support at $4.12 after a 10% jump over the last 24 hours. The altcoin bounced off $3.69, indicating that the recent correction may be over, and the next phase could involve an upward movement. The goal is to establish $4.12 as support and continue the bullish trend.

The next major resistance level for SUI is $4.35. To reach this price target, SUI must hold the $4.12 support level. If the token successfully secures this support, it could push toward $4.35, potentially leading to further gains.

However, the current market uncertainty remains a risk.

If the bullish momentum falters and investors begin to sell, SUI’s price could fall back to $3.93. Losing this support level would likely invalidate the bullish thesis, and SUI may struggle to regain upward momentum.