dApp Market Becomes 10% in May, DeFi TVL Falls Back 4.3%

To sum things up

- DeFi encountered a diminishing in all out esteem locked (TVL), however its portion of on-chain movement rose in May.

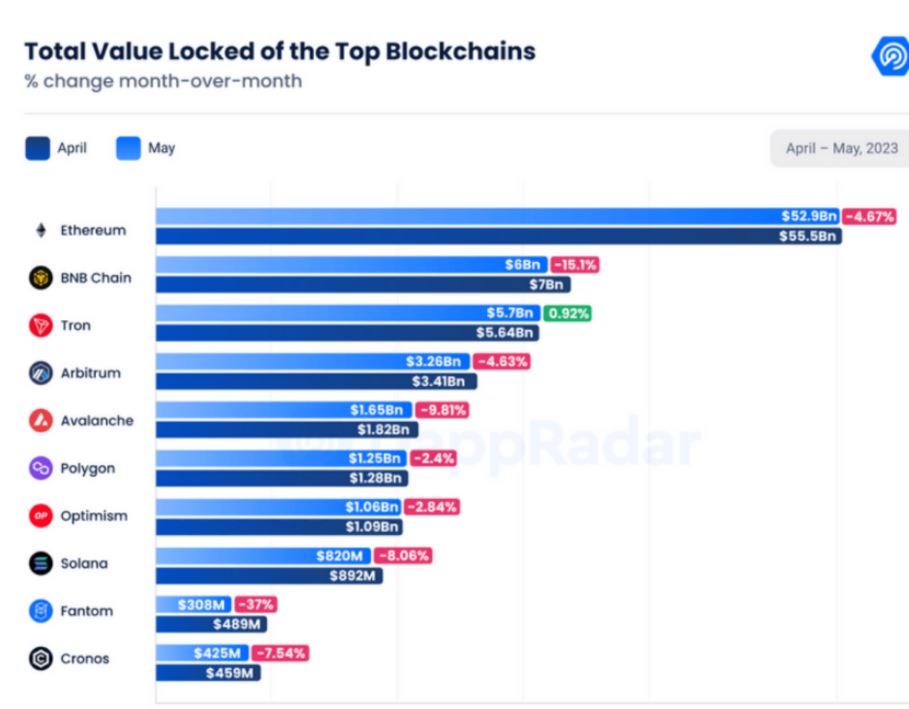

- Most blockchains saw relapses in TVL, aside from TRON which had slight development.

- In May, Blur dominated the market share, resulting in a significant decline in NFT trading volumes.

In May, the industry had mixed results, with DeFi seeing an increase in its share of on-chain activity despite a decrease in total value locked (TVL). While blockchains, with the exception of Tron, regressed in TVL, the dApp industry grew.

The crypto industry went through a mixed bag in May, according to the most recent DappRadar report, with various sectors simultaneously moving forward and backward.

Get to know Godleak

Godleak crypto signal is a service which comprise of a professional team. They tried to provide you signals of best crypto channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

Blockchain TVL Regresses

In May, the funds used in DeFi protocols, or the total value locked (TVL), decreased by 4.3 percent to $79.16 billion USD. DeFi’s share of on-chain activity, however, increased to 31%. Therefore, despite the fact that more users are utilizing its protocols, they are collectively playing with less.

However, it wasn’t all bad. The dApp business became by 9.97% in May, arriving at a normal of 1,967,051 day to day exceptional dynamic wallets (dUAW), mirroring a consistent expansion in web3 interest.

In May, the main takeaway for blockchains was regression, as TVL dropped almost everywhere. One exemption in the report was TRON, which grew a little under 1% throughout the month.

Fantom (FTM) was the biggest loser during this time period. Due to its association with the Multichain turmoil brought on by rumors of possible arrests in China, its TVL decreased by 37% to $308 million. The native token of Multichain, MULTI, experienced a significant decline of 49%, affecting Fantom’s assets and prompting a switch to Arbitrum.

NFT Trading Volumes Down

The NFT market’s mixed performance over the past month is indicative of a broader industry trend. For the first time since December 2022, NFT trading volume fell below $1 billion in May, with a sharp 44% decrease to $675 million compared to the previous month.

Blur achieved a market share of 65% in May 2023 and made $442 million from NFT sales. OpenSea, the former king of the NFT marketplaces, had $183 million in revenue and a 27 percent market share. OpenSea had a significantly higher number of traders than Blur, with 377,087, despite Blur’s dominance. Something we have known for a long time is reflected in this: A particular category of market participants are drawn to Blur. Specifically, those who prefer a technical focus on trading at higher frequencies rather than collecting data.

Blend, Blur’s NFT lending service, has, on the other hand, diverted some attention from the trading platform. NFT merchants’ moving from the previous to the last option has fundamentally added to the decrease in exchanging volume.