The countdown has started: Just One Year Until the Next Bitcoin Halving

Briefly

- the key event that reduced mining rewards, the halving of Bitcoin, influences market sentiment, increases the profitability of miners, and drives innovation in the crypto ecosystem.

- The price of Bitcoin is influenced by the halving, and institutional investors have a significant impact on how the market reacts to this development.

- The forthcoming splitting may provoke financial backers to investigate altcoins and lead to mechanical headways in blockchain productivity and exchange handling.

Experts and investors in the cryptocurrency industry are keeping a close eye on the anticipated impact on the market of the much-anticipated Bitcoin halving event, which will take place just one year from now.

BeInCrypto goes into greater depth about the intricacies of the halving phenomenon, including how it affects miners and the larger implications for the cryptocurrency ecosystem as a whole.

The Bitcoin Halving Unpacked

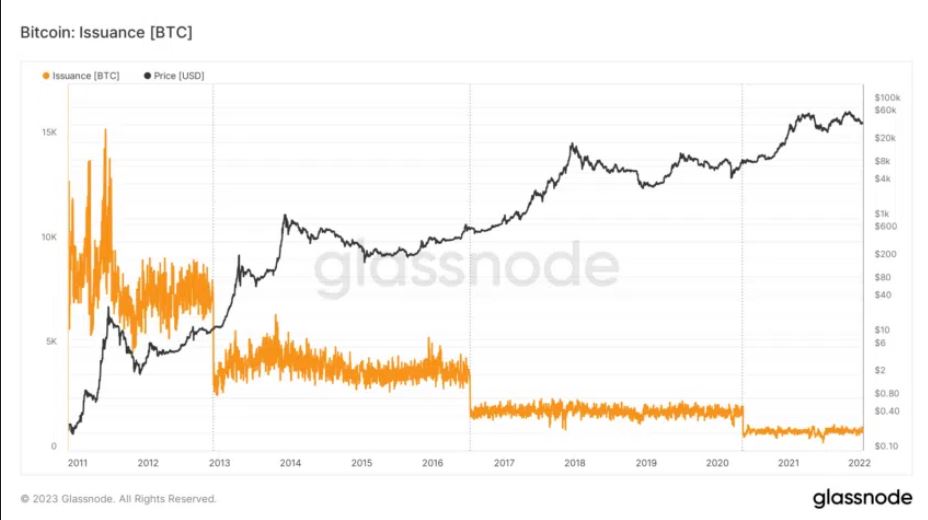

A fundamental component of the Bitcoin protocol is the halving. Every 210,000 blocks, or about every four years, it is designed to reduce the mining reward by 50%. This decrease serves two purposes. One is controlling Bitcoin’s expansion rate and copying the shortage of valuable metals like gold. The second is ensuring that the supply of new BTC entering the market is predictable and decreasing.

The primary goal of the halving event is to make Bitcoin’s environment deflationary. It slows down the rate at which new coins are produced over time. This scarcity aims to maintain BTC’s value over time, making it an appealing value store. Consequently, the halving mechanism is an essential part of Bitcoin’s economic viability over the long term.

Due to the reduced supply of new BTC, halving events have historically had a significant impact on Bitcoin’s price. For instance, in the months that followed each of the halving events in 2012, 2016, and 2020, the price of Bitcoin experienced significant increases as market participants anticipated a supply shock and increased demand for the scarcer asset.

The mining reward is currently 6.25 BTC per block. The mining reward will be reduced to 3.125 BTC per block following the next halving event, which is anticipated to take place in 2024. The number of new BTC that can enter the market will be further restricted by this reduction in mining rewards. As a result, as demand continues to rise despite a decreasing supply, this may result in an increase in the price.

Nevertheless, it is essential to keep in mind that past performance does not guarantee future outcomes. Following the halving, Bitcoin’s price can be influenced by a variety of factors, including macroeconomic trends, developments in regulatory policy, and market sentiment.

As a result, participants in the market ought to approach the upcoming halving event from a skewed perspective. It is essential to take into account both its historical significance and the distinctive elements that are influencing the current market landscape.

Get to know Godleak

Godleak crypto signal is a service which comprise of a professional team. They tried to provide you signals of best crypto channels in the world.

It means that you don’t need to buy individual crypto signal vip channels that have expensive prices. We bought all for you and provide you the signals with bot on telegram without even a second of delay.

Godleak crypto leak service have multiple advantages in comparision with other services:

- Providing signal of +160 best crypto vip channels in the world

- Using high tech bot to forward signals

- Without even a second of delay

- Joining in +160 separated channels on telegram

- 1 month, 3 months , 6 months and yearly plans

- Also we have trial to test our services before you pay for anything

For joining Godleak and get more information about us only need to follow godleak bot on telegram and can have access to our free vip channels. click on link bellow and press start button to see all features

https://t.me/Godleakbot

Also you can check the list of available vip signal channels in the bot. by pressing Channels button.

Historical BTC Price Performance

Similar to previous halvings, experts anticipate that the halving could result in significant price shifts for BTC. But the outcome can be affected by things like the state of the global economy, new regulations, and the strategies of institutional investors.

In the 2012 splitting, Bitcoin’s cost expanded from around $11 in November 2012 to a pinnacle of roughly $1,100 in November 2013, denoting a momentous increment soon.

Bitcoin was still a relatively new concept at this time. Additionally, retail investors and early adopters who saw the potential of decentralized digital currency drove the market.

Bitcoin’s price increased from approximately $650 in July 2016 to nearly $20,000 in December 2017 as a result of the 2016 halving. During this time, market sentiment was mostly positive. It was sparked by the entry of institutional investors, a rise in initial coin offerings (ICOs), and increased coverage in mainstream media.

Nonetheless, market volatility was exacerbated by regulatory developments like restrictions on ICOs and attempts to impose stricter regulations on crypto exchanges.

Bitcoin’s price rose from approximately $9,000 in May 2020 during the 2020 halving event to an all-time high of approximately $69,000 in November 2021. Major corporations and investment funds entered the cryptocurrency market during the 2020 halving, resulting in increased institutional interest.

Additionally, the COVID-19 pandemic had a significant impact on market sentiment. Demand for Bitcoin as a digital store of value increased as the global economic downturn and unprecedented fiscal stimulus measures raised concerns about currency devaluation and inflation.

Particularly, institutional investors have a significant influence over the market. Their response to the halving event may have a significant impact on Bitcoin’s price and the cryptocurrency market as a whole.

For instance, Bitcoin’s price increased during the 2020 halving due to institutional investors’ growing interest in it as a hedge against inflation and macroeconomic uncertainties.

The Impact on Miners

Mining rewards will be cut by 50% during the upcoming halving event, putting a significant financial strain on Bitcoin miners. Miners may be forced to modify their operations in order to maintain profitability and continue supporting the network as a result of this reduction in rewards.

Miners may decide to invest in more energy-efficient and powerful hardware to improve their mining operations in response to the reduced rewards. Miners have the ability to lower their operational costs and energy consumption by making use of cutting-edge technology. Increasing their odds of successfully mining new blocks and earning rewards in the meantime.

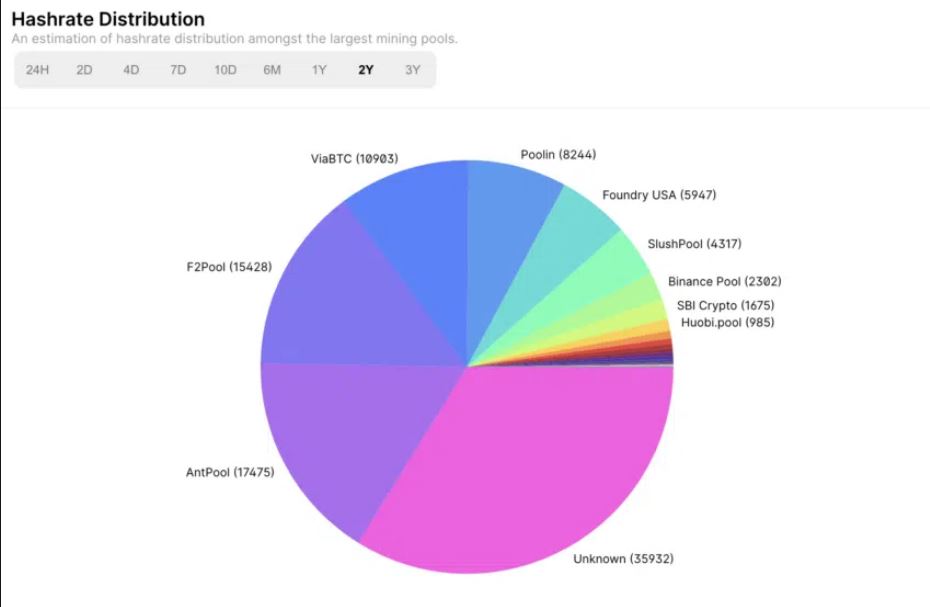

However, smaller miners may be disproportionately affected by the increased costs of upgrading equipment and improving energy efficiency. In many cases, these smaller mining operations lack the financial resources necessary to compete with larger mining pools that are well-funded.

As a result, it’s possible that some smaller miners will have to leave the market. In order to share resources and reduce risks, they may also be forced to merge with larger mining operations.

A growing proportion of the network’s mining power could be controlled by a few large mining pools as a result of this potential exit of smaller miners. The resilience and security of the network could be compromised by this centralization. It could make the network more susceptible to manipulation or attacks.

By concentrating control over the network in the hands of a small number of individuals, a greater degree of centralization may also undermine one of Bitcoin’s fundamental principles, decentralization.

Additionally, miners may seek out locations with lower energy costs or more favorable regulatory environments as a result of the halving’s impact on the mining industry. The geographical distribution of mining operations could change as a result, affecting the decentralization of the network even more.

Wider Implications for the Crypto Market

The impending Bitcoin splitting occasion is supposed to have more extensive ramifications for the whole digital money market. Investors, miners, and users may focus on altcoins with better mining rewards, more effective consensus mechanisms, or distinctive value propositions tailored to specific use cases or industries as mining rewards decrease.

Altcoin adoption and interest could rise as a result of this shift in focus. As a result, their prices, market capitalization, and overall significance to the cryptocurrency ecosystem will be affected.

For instance, cryptos that are less susceptible to the effects of halving events could be used to diversify investors’ portfolios. These include those that do not rely on mining for token distribution and network security and use Proof of Stake (PoS) consensus mechanisms.

Additionally, the halving event may act as a catalyst for blockchain industry technological innovation. New approaches to enhancing transaction processing capabilities, reducing energy use, and maximizing mining efficiency may be investigated by developers and researchers.

Consensus mechanisms, Layer-2 scaling solutions, and blockchain architectures that address Bitcoin’s current limitations could emerge as a result of these advancements.

The dividing occasion may likewise incite a reconsideration of the ongoing business sector elements. It could draw attention to the effects of mining and the long-term viability of Proof of Work (PoW) networks. This investigation could urge the business to take on additional maintainable and proficient innovations. Innovative solutions that strike a balance between decentralization, security, and environmental concerns may also be encouraged.

Furthermore, the halving could impact regulatory developments in the cryptocurrency space. As the event garners attention from investors, governments, and financial institutions, it may trigger discussions around the appropriate regulatory framework for cryptocurrencies and the need for clearer guidelines to ensure market stability, investor protection, and compliance with existing financial regulations.